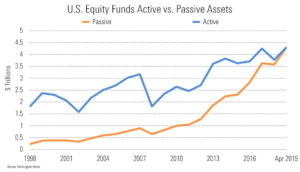

According to Morningstar, passive equity funds have now passed active equity funds in terms of asset under management. The graph below puts a picture to the numbers.

Source: Citywire

With the war over for domestic equities seemingly over. The question is what kind of headway passive investing can make headway into other asset classes. From a Nicole Piper article at CityWire:

‘The question now is the degree to which active management will remain the preferred destination for investors in other asset classes, such as international equities and taxable-bond funds,’ Tom Lauricella and Gabrielle Dibenedetto said in a Morningstar commentary.”

Julie Segal at Institutional Investor writes:

It’s not all bad news for active managers: Investors still prefer active strategies in areas of the market where information is less available and trading is more difficult. For one, 95 percent of municipal bonds are in active strategies. Investors also still prefer active managers in international stocks and taxable bond funds.

Three years ago I wrote a post, The Bernstein Curve, speculating that equity market would eventually reach this situation, roughly a 50/50 split between active and passive strategies. The speed by which it happened points toward a bigger eventual share for index funds. It’s hard to imagine what would reverse this trend, absent high, sustainable alpha from active managers.

The underreported part of the story is the role the ETF has played in all this. It’s not a coincidence that the rise of the ETF vs. the open-end mutual fund has come along with the rise of index funds. Cinthia Murphy at ETF.com writes:

The ETF market is predominately the realm of passive management. About 90% of all ETFs are passively managed, and together, they command 98% of all U.S.-listed ETF assets—more than $3.5 trillion.

Presumably non-transparent, actively managed ETFs could help reverse the trend but don’t hold your breath. We are living in an index world and active managers are going to need more than a new fund structure to make headway against the runaway, index fund train.