Wednesdays are all about personal finance here at Abnormal Returns. You can check out last week’s links including a look at what you can learn when you go through the financial planning process.

Quote of the Day

"The best way to sustain passion in one area of life is to have other things that renew you in times of disappointment."

(Brett Steenbarger)

Chart of the Day

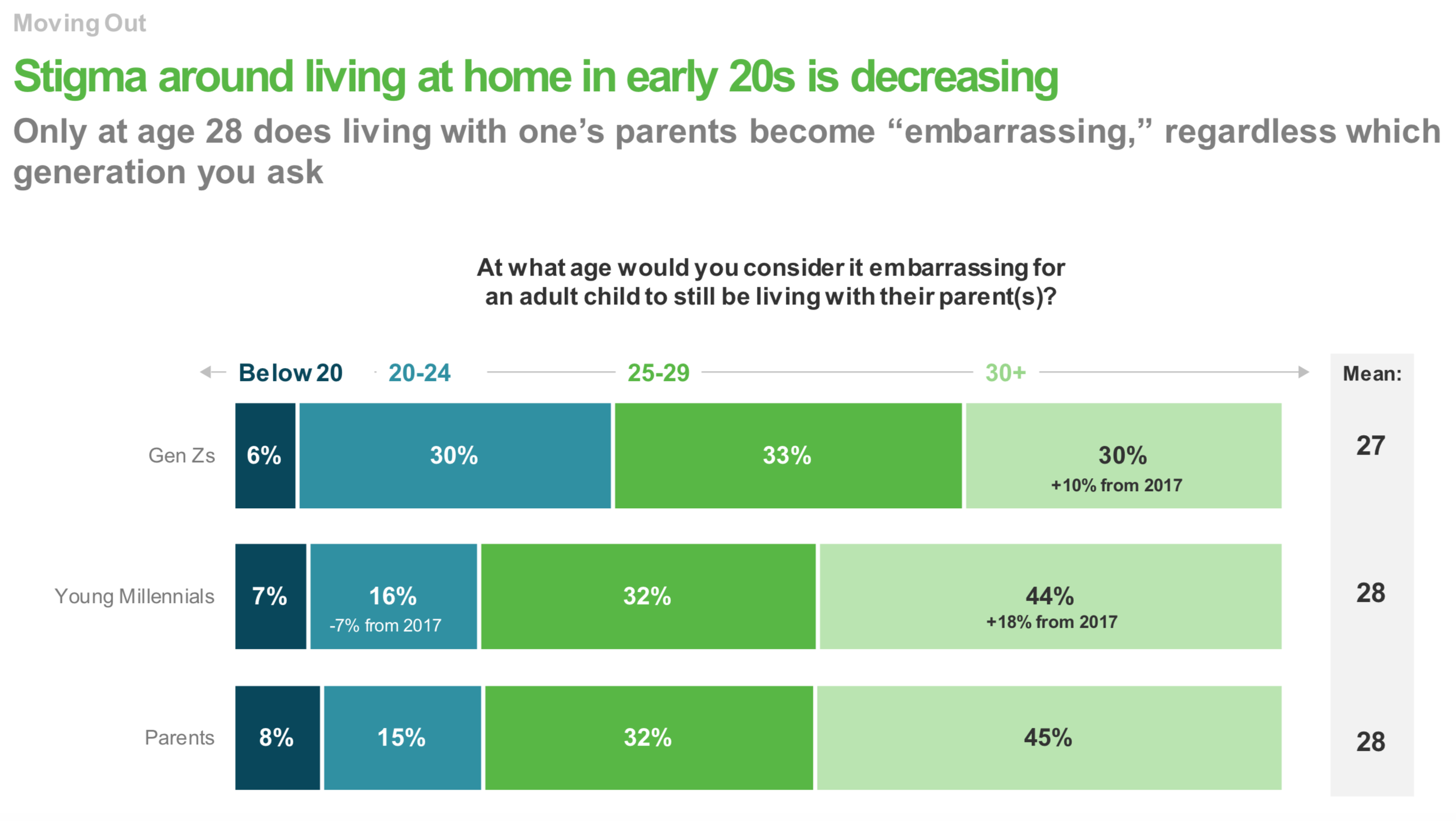

The stigma around moving back home in your 20’s is evaporating. (chart via Ameritrade)

Retirement

- A portfolio strategy for 30-year retirements. (retirementfieldguide.com)

- There's only a few ways to make sure you money lasts a lifetime. (behavioralvalueinvestor.com)

- Baby Boomers are re-thinking the nature of retirement communities. (barrons.com)

Kids and money

- A comprehensive financial checklist for your high school graduate no matter what their next step in life may be. (nytimes.com)

- When to talk to kids about the different aspects of money. (vanguardblog.com)

Money and happiness

- The relationship between money and happiness is non-linear or why the poor AND the rich have money-related stress. (ofdollarsanddata.com)

- Wealth is "funded contentment." (blairbellecurve.com)

Lessons

- Lesssons learned from the second edition of Ramit Sethi's book "I Will Teach You to Be Rich." (thewaiterspad.com)

- The seven deadly sins of personal finance. (getrichslowly.org)

Personal finance

- The whole latte-a-day meme has been beaten to death, but it is worth putting a value on the trade-offs. (bonefidewealth.com)

- Are there some people who do not need an emergency fund? (whitecoatinvestor.com)

- How the math of life expectancy differs for couples vs. singles. (monevator.com)

- The SECURE Act provides additional retirement account flexibility with the big risk of annuities in your 401(k) plan. (nytimes.com)

- Doing the math on a life insurance policy. (theirrelevantinvestor.com)

- Here are some credit card perks you may be missing out on. (awealthofcommonsense.com)