Thursdays at Abnormal Returns are all about startup and venture capital links. You can check out last week’s links including a look at Scott Kupor’s new book “Secrets of Sand Hill Road: Venture Capital and How to Get It.”

Quote of the Day

"Your business might be helping people, enriching lives or even saving them, and still not be the right fit for raising VC."

(Scott Kupor)

Chart of the Day

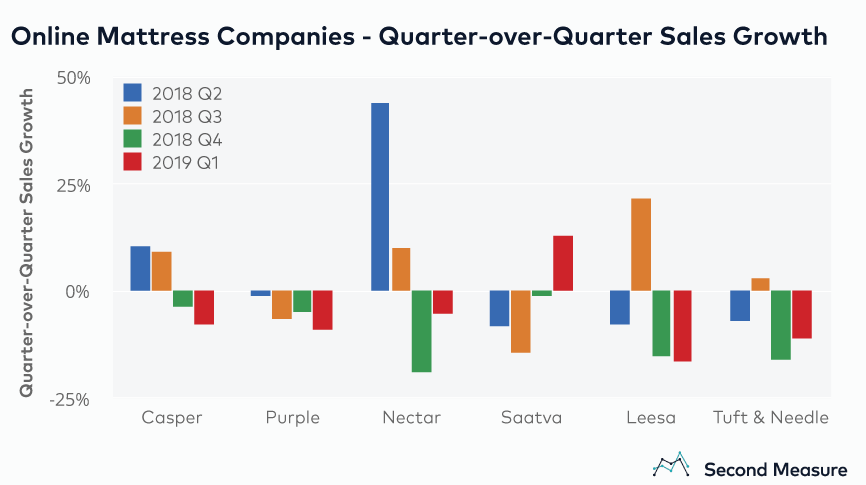

The online mattress startups have apparently burned through any pent-up demand.

Big picture

- Mary Meeker's 2019 Internet Trends slide deck. (vox.com)

- Demographics have a role to play in the 'startup deficit.' (papers.ssrn.com)

Venture

- Fred Wilson, "It takes seven to ten years to get to real liquidity in a portfolio of early stage venture investments." (avc.com)

- The Midwest continues to face a dearth of venture capital, especially at Series A and up. (pointsandfigures.com)

- A look inside Sequioa's now-famous scout program. (techcrunch.com)

Founders

- Why product innovation slows after a Series A, including technical debt. (tomtunguz.com)

- 50 things learned from the first 90 days running a company. (medium.com)

- You have to recognize ahead of time that a startup is an emotional roller coaster ride. (firstround.com)

Startups

- Scott Kuper has struck an admirable balance in writing a book, "Secrets of Sand Hill Road," that appeals to many types of people with different levels of expertise. (25iq.com)

- Loyalty is the ultimate company moat. (kyletibbitts.com)

- As IPOs continue to roll out, many early holders are able to take advantage of the QSBS exemption. (bloomberg.com)

- Paris is the largest electric scooter market in the western world right now. (avc.com)