Tuesdays are all about academic (and practitioner) literature at Abnormal Returns. You can check out last week’s links including a look at a big research piece showing the distortions caused by inflation to corporate earnings.

Quote of the Day

"Here I will just remind everyone, including myself, that this is all much harder to do in real life than many think before experiencing these times."

(Cliff Asness)

Chart of the Day

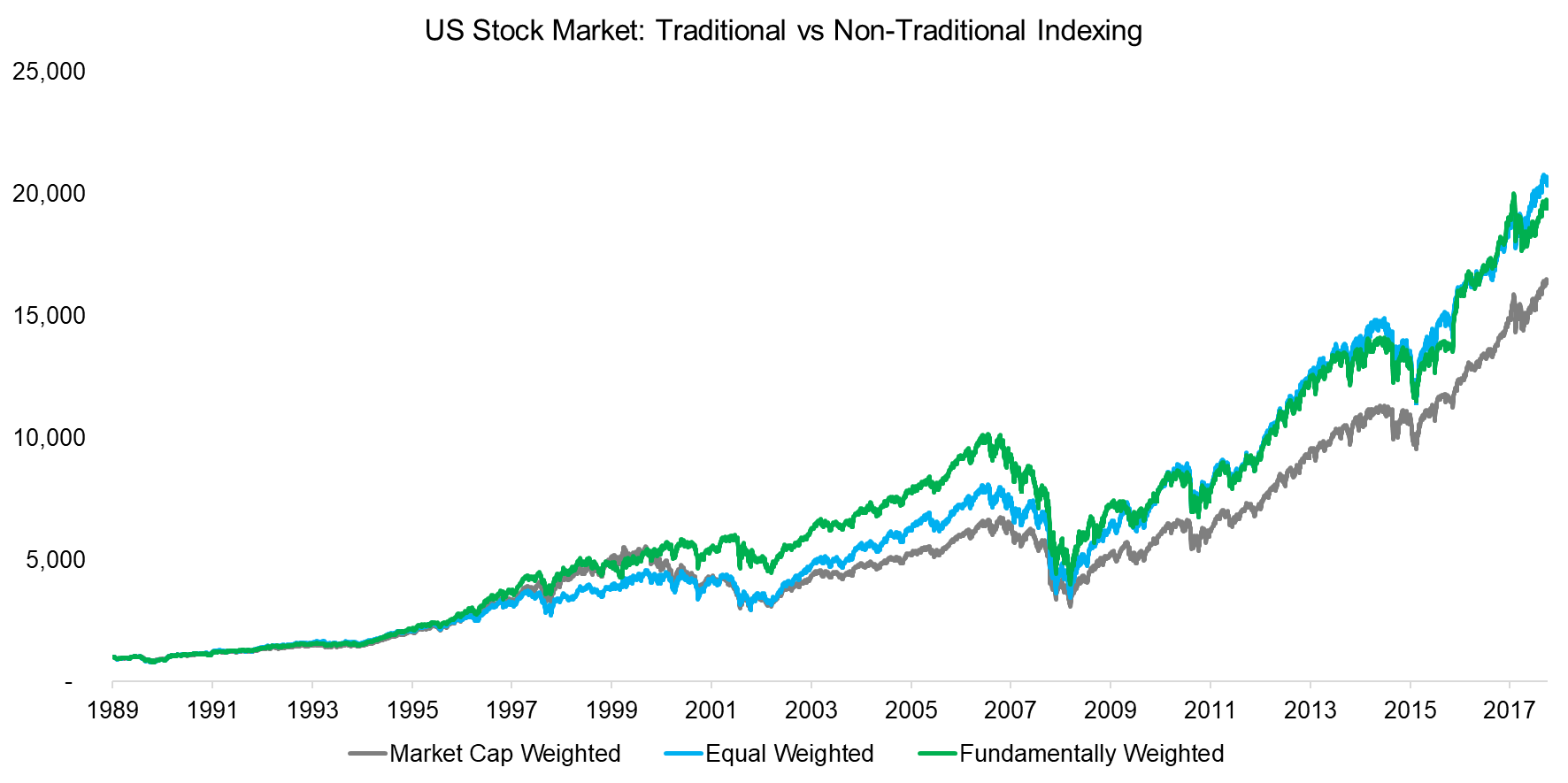

A look at the performance of equal and fundamental-weighted indices vs. market cap since 1990. (via @factorresearch)

Efficiency

- Academics do help make markets more efficient. (mrzepczynski.blogspot.com)

- The more skilled active managers are, the less of it we need. (papers.ssrn.com)

Fixed income

- Investors have historically not demanded enough compensation for credit risk. (blog.thinknewfound.com)

- A summary of recent research on the yield curve. (capitalspectator.com)

Factors

- Value investing has historically underperformed during periods of technological transition. (osam.com)

- "Yang and Zhang found that extreme absolute strength stocks are more likely to have momentum reversals, hurting the profitability of momentum strategies." (alphaarchitect.com)

- Trade execution plays a big role in realized factor returns. (institutionalinvestor.com)

- The evidence for the size effect keeps getting weaker. (alphaarchitect.com)

Research

- Protective puts are not all that great a tail-risk strategy. (alphaarchitect.com)

- The evidence on the effectiveness of activist investors is mixed. (investorschronicle.co.uk)

- Why do sell-side analysts consistently underestimate earnings? (review.chicagobooth.edu)

- How much are subscription lines of credit distorting private equity fund returns? (institutionalinvestor.com)

- Four ways in which ETFs could represent a systemic financial risk. (esrb.europa.eu)

- Why Monte Carlo simulations with static spending rules in retirement way oversimplify things. (blog.thinknewfound.com)