Thursdays at Abnormal Returns are all about startup and venture capital links. You can check out last week’s links including a look at the fallout from the WeWork debacle.

Quote of the day

“What impact do you have on clients? How profitable are you?” – Julian Hebron

Chart of the day

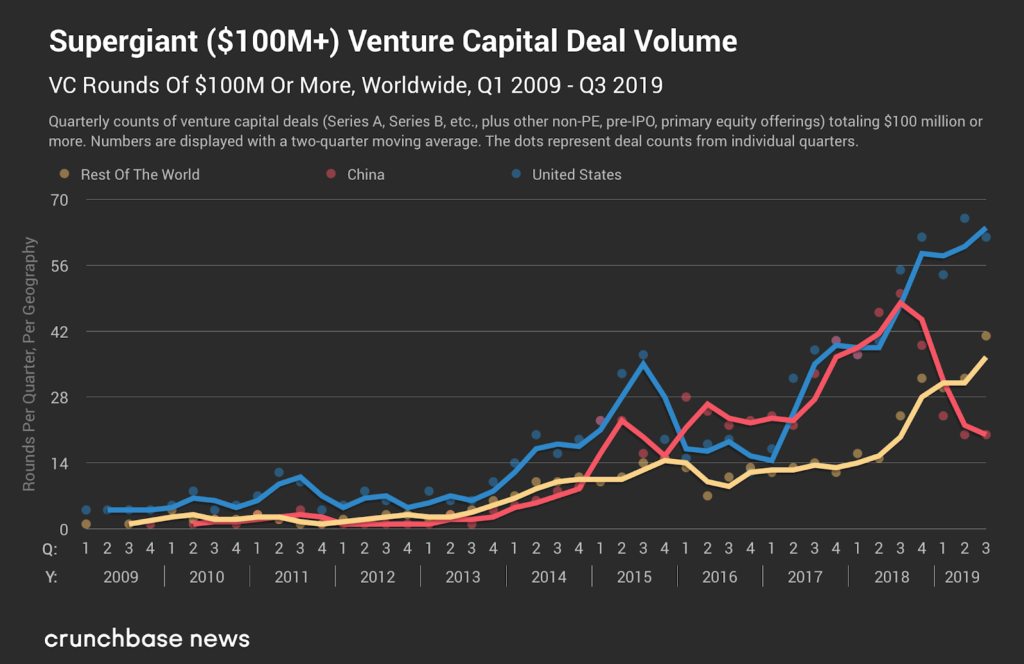

Big fundraising rounds are in decline in China. (Crunchbase)

Software

- Open source is expanding into more areas of software. (a16z.com)

- Benedict Evans, "ML is the new SQL." (ben-evans.com)

Lessons learned

- Twenty lessons learned from two failed startups including: "The more your company grows, the more it owns you." (marker.medium.com)

- A letter to a friend who may start a new business. (grahamduncan.blog)

Venture capital

- How the early-stage funding market has changed over the past decade. (tomtunguz.com)

- "Almost half of all [VC] funds raised this year are at least $100 million in size, up from about 30 percent in 2014, according to PitchBook." (institutionalinvestor.com)

- Bessemer Venture Partners is raising a fund to invest in later-stage start-ups that want to remain private for longer. (ft.com)

Hiring and talent

- How to better model employee stock options to take into account this very important feature of working at a startup. (benkuhn.net)

- Why remote and distributed companies invest in human resources functions earlier on in their existence. (tomtunguz.com)

- How astrophysicists became a go-to source of tech talent for startups. (wired.com)

Brands

- Calm wants to help people "reduce stress, sleep better and handle anxiety." (latimes.com)

- Meat Eater has become a big, and growing, outdoor brand. (axios.com)

Startups

- Why the co-founder relationship is so important to a startup's success. (firstround.com)

- On the benefits of launching a startup in Canada. (venturebeat.com)

- Everybody loves newsletters, but are they an actual (fundable) business? (theatlantic.com)

- Positive-unit economics is the new watchword in Silicon Valley. (nytimes.com)