Defaults matter. There is little doubt they have a big influence on financial decision making.

For a long time mutual funds were the default investment vehicle of choice for investment advisers. Today that default is now indexed ETFs. I have long argued that ETFs are a powerful innovative, one could even say disruptive, force. For example, the entire robo-advisor space is built on the back of the ETF structure. So despite the power and market share of the industry’s largest players, there is still (hopefully) room for innovation in ETF-land.

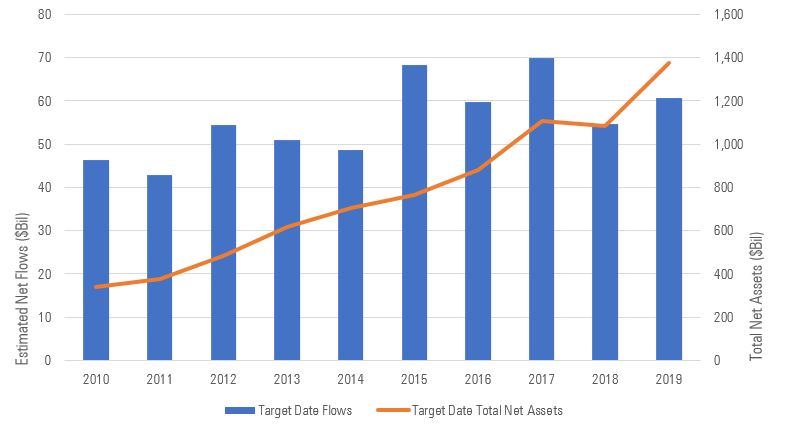

Source: Morningstar

We may now need to add another entry to the pantheon of financial innovation. A recent paper by Olivia S. Mitchell and Stephen Utkus entitled “Target Date Funds and Portfolio Choice in 401(k) Plans” argues that TDFs have been a powerful force for better investor behavior and outcomes. From the paper’s abstract*:

Target date funds in corporate retirement plans grew from $5B in 2000 to $734B in 2018, partly because federal regulation sanctioned these as default investments in automatic enrollment plans. We show that adopters delegated pension investment decisions to fund managers selected by plan sponsors. Including these funds in retirement saving menus raised equity shares, boosted bond exposures, curtailed cash/company stock holdings, and reduced idiosyncratic risk. The adoption of low-cost target date funds may enhance retirement wealth by as much as 50 percent over a 30-year horizon.

Target date funds aren’t perfect, but the evidence shows they are preferable to DIY solutions.

ETFs have not made their way into 401(k) plans and target date ETFs have not taken off. So comparing ETFs and TDFs isn’t an apples-to-apples comparison. Taken on their own they are both powerful financial innovations. Innovations that provide investors with better solutions and (hopefully) more wealth when they really need it.