Tuesdays are all about academic (and practitioner) literature at Abnormal Returns. You can check out last week’s links including a look at whether fincial literacy education actually works.

Quote of the Day

"Today, the two biggest statistical predictors of future small value returns are at some of their highest readings ever on record."

(Verdad Capital)

Chart of the Day

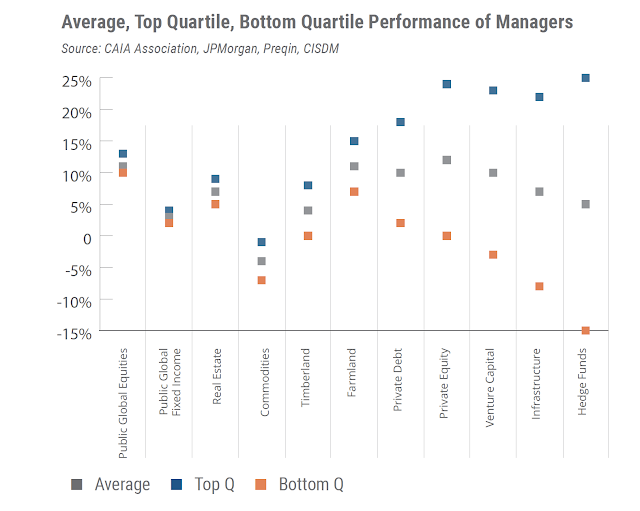

Performance dispersion among alternative assets is both a challenge and an opportunity.

Research

- Value investing has history on its side, but it's been a rough decade, or so. (twocenturies.com)

- What's the story behind EBIT/TEV? It's "more intuitive and broadly applicable to investing in today’s economy." (alphaarchitect.com)

- Stock investors have had the odds in their favor historically. (ofdollarsanddata.com)

- It's hard to argue there is much value in following a merger arbitrage strategy these days. (factorresearch.com)

- Mark Rzepczynski, "The CTAs that do not follow the crowd or follow the time series momentum factor are not rewarded for their uniqueness." (mrzepczynski.blogspot.com)

- Do high Glassdoor ratings predict higher stock returns? (glassdoor.com)

- How Fed intervention helped stabilize the Treasury bond market. (brookings.edu)