Tuesdays are all about academic (and practitioner) literature at Abnormal Returns. You can check out last week’s links including a look at the long history of the value and momentum factors.

Quote of the Day

"Backtesting if not done properly is as dangerous as generating random trades with a fair coin and often with a worse-than-random coin."

(Michael Harris)

Chart of the Day

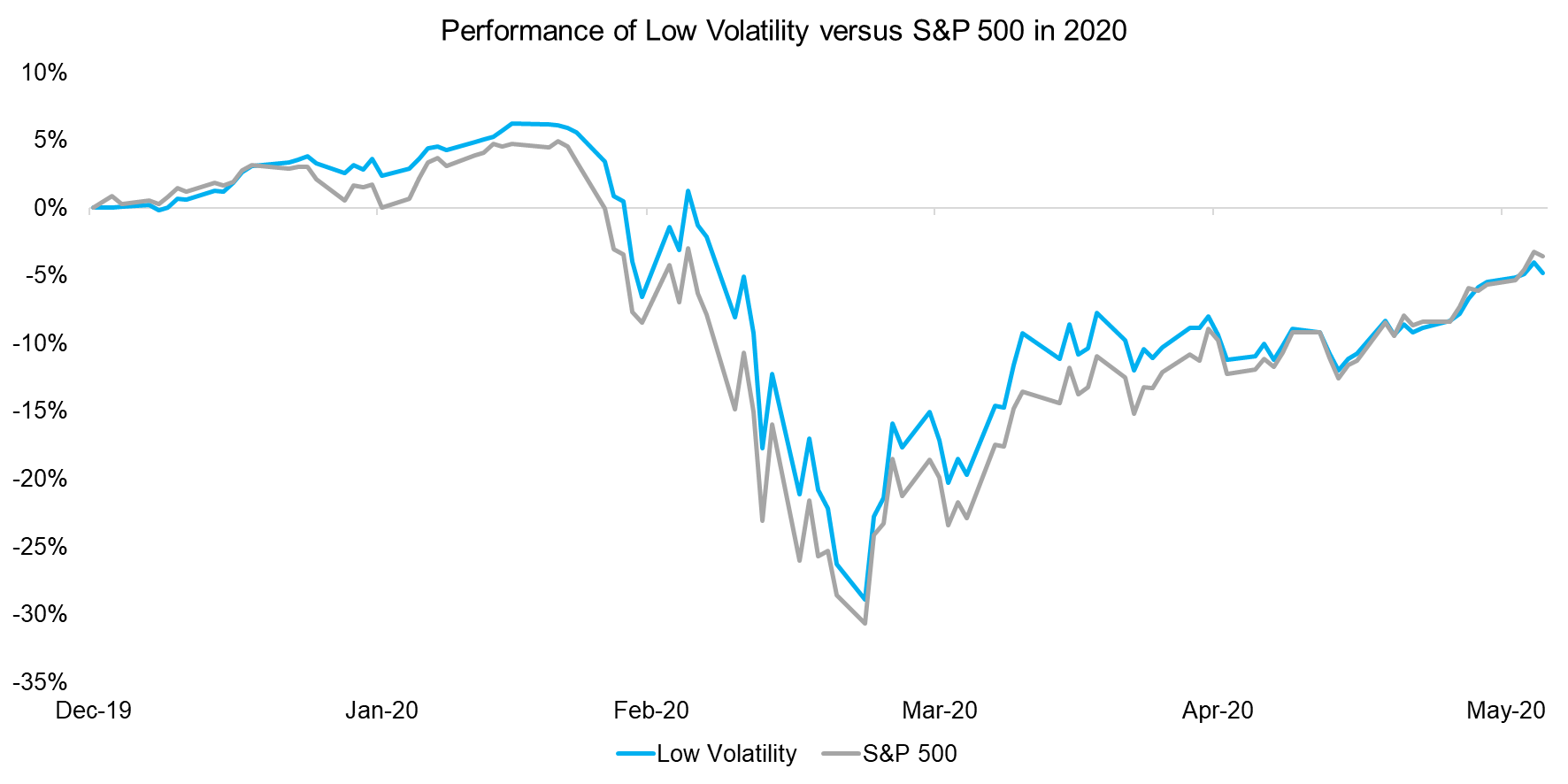

An examination of recent low vol performance, including during the March-April drawdown.

Value

- Is systematic value investing dead? Some evidence against that proposition. (alphaarchitect.com)

- Do interest rates explain value's underperformance. Not really... (alphaarchitect.com)

Behavior

- Many investors fundamentally misunderstand the nature of stock dividends. (allaboutalpha.com)

- Are reckless CEOs made or born? Mostly born. (klementoninvesting.substack.com)

- Did partisanship affect how investors thought about the fall in stocks? Some data from StockTwits. (papers.ssrn.com)

Quant stuff

- Some lessons from the math behind 50 delta options. (moontowermeta.com)

- Machine learning algorithms did not have pandemic market data to train on, until now. (allaboutalpha.com)

Research

- Historically dynamic portfolios have outperformed static mixes. The challenge is implementation. (elmfunds.com)

- When it comes to long term fixed income returns, inflation rules all. (factorresearch.com)

- Factor investing may not be dead, but maybe it's not worth the bother? (alphaarchitect.com)

- If ESG doesn't generate alpha what does? Combining it with employee satisfaction scores. (institutionalinvestor.com)

- Research shows that after fees, private equity returns pretty much match public equities. (institutionalinvestor.com)