Tuesdays are all about academic (and practitioner) literature at Abnormal Returns. You can check out last week’s links including a look at the dangers of doing backtesting incorrectly.

Quote of the Day

"Investors generally “value” businesses using multiples...Multiples are not valuation."

(Michael Mauboussin)

Chart of the Day

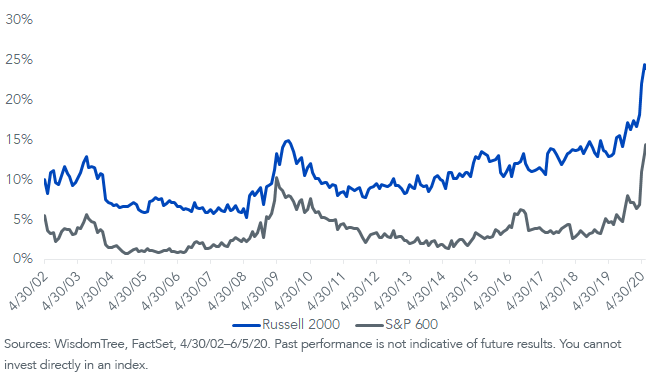

Small cap indices are increasingly made up of companies with negative earnings.

Asset management

- Social and geographic links matter when it comes to investment decision making. (privpapers.ssrn.com)

- Research shows asset management has on of the highest "career premiums." (institutionalinvestor.com)

Factors

- Five big takeaways from a big replicating study of academic anomaly research including the survival of classic factors like value and momentum. (alphaarchitect.com)

- The quality factor is not easily defined. (blog.validea.com)

- Most smart beta funds are not all that smart. (privpapers.ssrn.com)

- Equity factor crowding is a real thing. (alphaarchitect.com)

Quant stuff

- How the 2020 stock market is going to confound anyone doing a backtest. (awealthofcommonsense.com)

- A research roundup on forecasting. (capitalspectator.com)

- The CFA Institute now makes available the Morningstar SBBI data on its site. (klementoninvesting.substack.com)

Asset allocaiton

- How to explain poor public pension fund performance. (evidenceinvestor.com)

- How different TAA strategies have handled the bounce back in markets. (portfoliocharts.com)

- Stocks don't always beat bonds even over multi-decade horizons. (wsj.com)

Research

- Why buying the equity of companies in bankruptcy, or distress, is a bad idea. (mailchi.mp)

- Trend following returns are dependent on how many turning points an asset experiences. (mrzepczynski.blogspot.com)

- Large cap pricing efficiency is increasing. Small caps, not so much. (klementoninvesting.substack.com)

- The problem with assessing naive tail-risk option strategies. (blog.thinknewfound.com)

- It's not clear that automatic enrollment in retirement plans actually increases overall savings rates. (privpapers.ssrn.com)