Tuesdays are all about academic (and practitioner) literature at Abnormal Returns. You can check out last week’s links including a look at why 2020 is going to confound researchers for a long time to come.

Quote of the Day

"There is no much money to be made selling trading software that does not come with extraordinary claims of potential profits or promises of one-click solutions."

(Michael Harris)

Chart of the Day

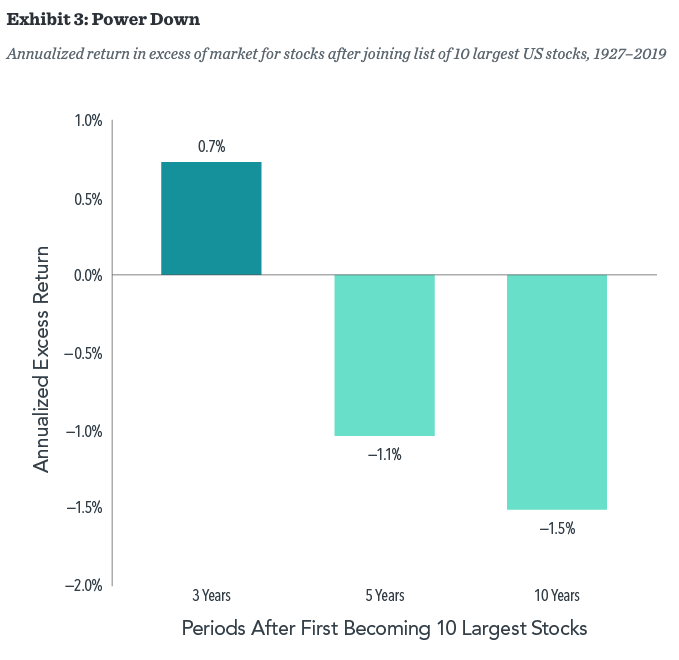

Historically being one of the ten largest stocks has not been a good thing for returns going forward.

Hedge funds

- Asymmetric payoffs have made hedge funds a bad deal for investors. (papers.ssrn.com)

- It's hard to be encouraged by long-short equity fund performance over the past few years. (institutionalinvestor.com)

Anomalies

- Is the asset growth anomaly more about financing risk? (privpapers.ssrn.com)

- Trading costs wipe out the overnight return anomaly. (alphaarchitect.com)

- Established anomalies don't have much in the way of payoff once you take into account these issues. (privpapers.ssrn.com)

Research

- Junkier bonds need not generate higher returns: the case for fallen angels. (morningstar.com)

- Do options trades inform stock prices? Kinda, sorta. (alphaarchitect.com)

- How much of the drop in listed US companies is do to M&A activity? (privpapers.ssrn.com)

- Analysts should be wary of first impression bias. (mrzepczynski.blogspot.com)