Tuesdays are all about academic (and practitioner) literature at Abnormal Returns. You can check out last week’s links including a look at whether ESG is a standalone factor.

Quote of the Day

"Diversification of momentum timeframes improves a strategy because the investment behavior of momentum traders varies. All traders do not look at momentum the same way."

(Mark Rzepczynski)

Chart of the Day

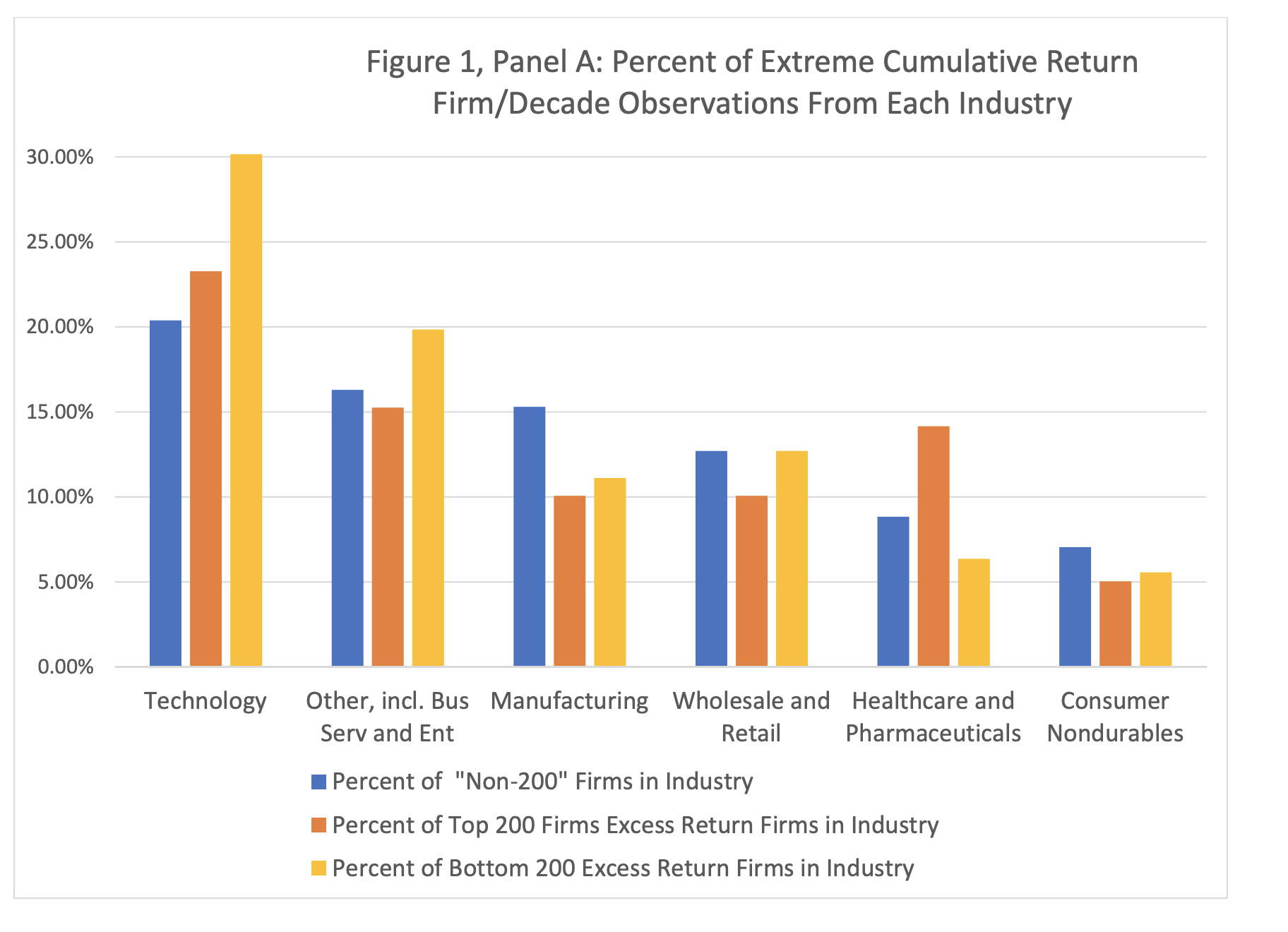

Technology stocks are among the market’s biggest winners but also dominate the list of the losers as well.

Corporate finance

- Evidence on how the gender gap presents itself in capital allocation decisions inside corporations. (alphaarchitect.com)

- Corporate responsibility initiatives can actually attract hedge fund activists who fear 'greenwashing.' (ft.com)

- How CEO stress affects aging. In short, not well. (marginalrevolution.com)

Portfolio construction

- Potential errors in the portfolio construction process are always present. (breakingthemarket.com)

- Let's face it: most asset classes are bets on economic growth. What can you do to truly diversify? (factorresearch.com)

Research

- Yes, fundamentals matter, but systematic value may very well be dead. (alphaarchitect.com)

- There is no single risk parity formula. (rcmalternatives.com)

- Is relative skew a priced factor? (alphaarchitect.com)

- Private equity returns are weighed down by high fees. (papers.ssrn.com)

- How Canada's public pensions stack up against those in the US. (privpapers.ssrn.com)

- Why academics publish research papers demonstrating ways to beat the market. (advisorperspectives.com)