Tuesdays are all about academic (and practitioner) literature at Abnormal Returns. You can check out last week’s links including a look at how to fix value investing.

Quote of the Day

"There have been many market regimes in the century of data upon which most major investment factors are based. It may just be that the unique nature of the Covid-19 shock was perfectly designed to short-circuit many of them — and the effect will fade as the pandemic eventually recedes."

(Robin Wigglesworth)

Chart of the Day

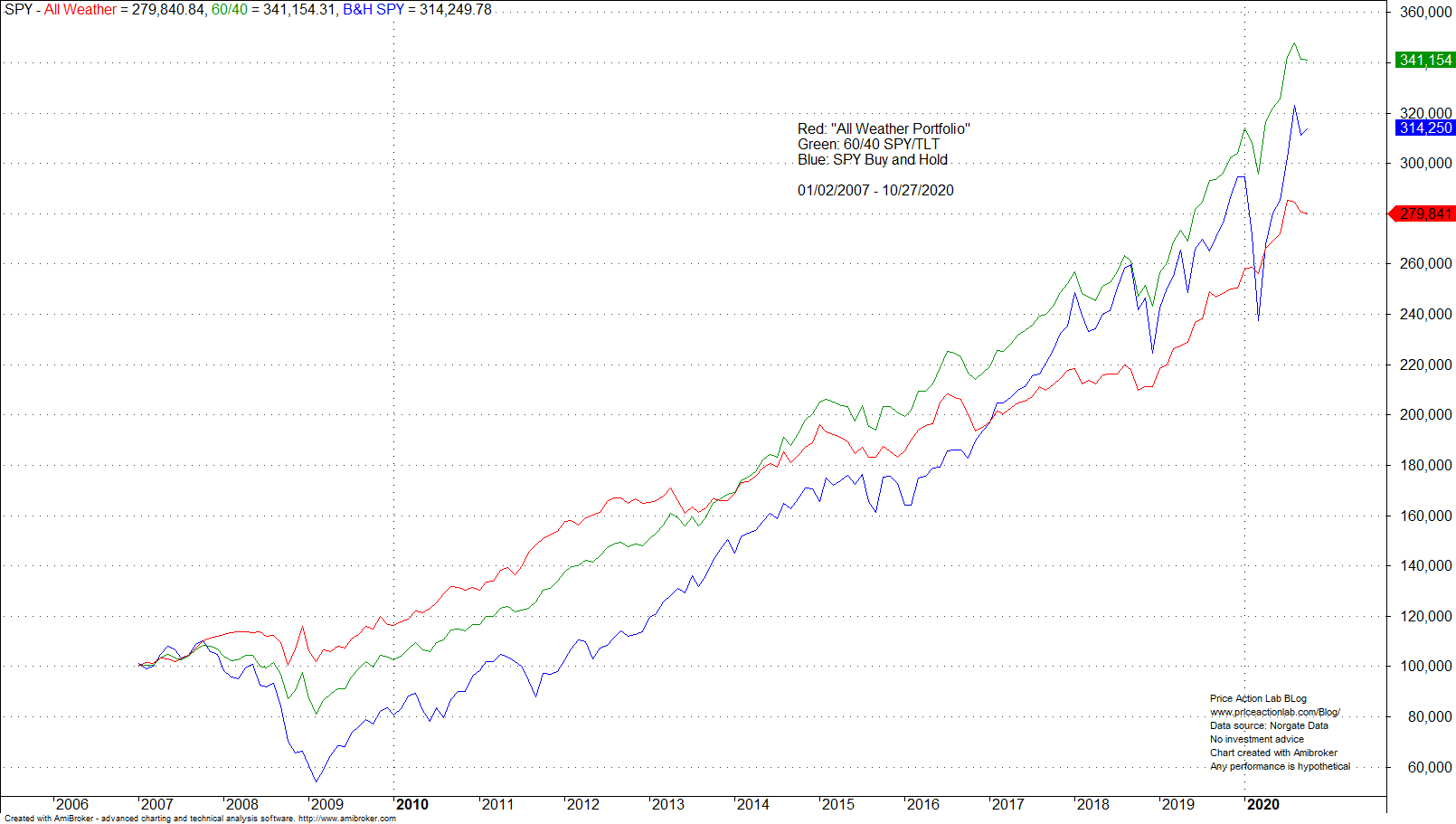

All-weather portfolio returns have historically come with reduced returns.

Trend following

- Making the case for diversifying via relative asset class momentum. (dualmomentum.net)

- How to use trend following as a substitute for a bond allocation. (mrzepczynski.blogspot.com)

Research

- What countries have the most 'zombie stocks'? (allaboutalpha.com)

- How adding profitability factors can enhance a value strategy. (alphaarchitect.com)

- An analysis of the performance of target date mutual funds. (privpapers.ssrn.com)

- The returns surrounding M&A deals don't tell us much about the future performance. (privpapers.ssrn.com)

- Research shows investors discount anonymous stock research. (institutionalinvestor.com)

- A round-up of October's white papers including "Investments in the Intangible Economy." (bpsandpieces.com)