Tuesdays are all about academic (and practitioner) literature at Abnormal Returns. You can check out last week’s links including a look at whether the price of Bitcoin is being manipulated.

Quote of the Day

"The competition to find superior models is what advances our understanding not only of the markets but also about which factors to focus on when selecting the most appropriate investment vehicles and developing portfolios."

(Larry Swedroe)

Chart of the Day

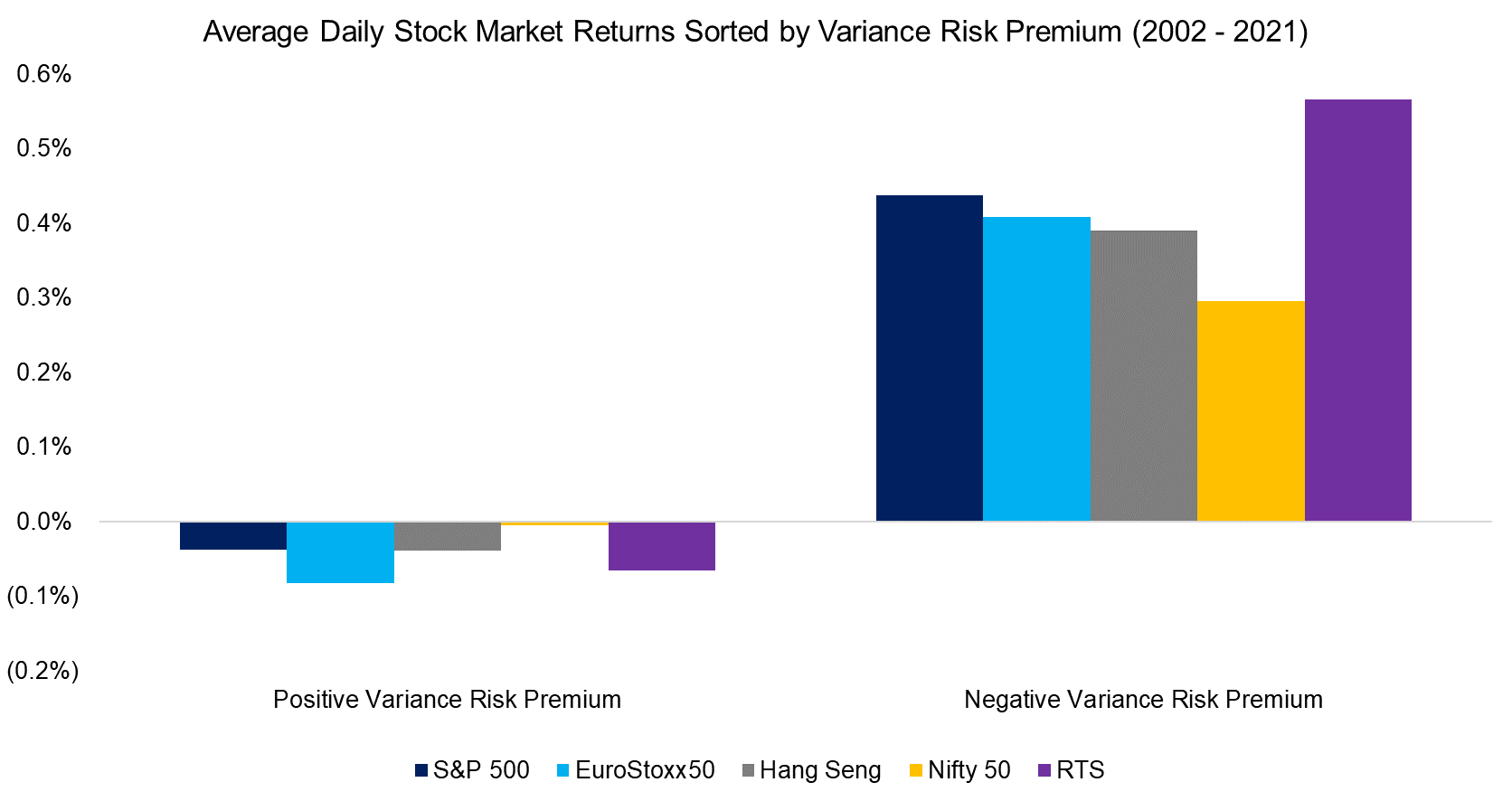

When the variance risk premium is negative stocks have a strong tendency to perform well.

Thematic ETFs

- Beware the launch of thematic ETFs. (papers.ssrn.com)

- When the hype fades: the case of thematic ETFs. (abnormalreturns.com)

Credit

- Markets care a lot more about credit downgrades than upgrades. (link.springer.com)

- Bond pricing is still a matter of opinion, not fact. (morningstar.com)

Alternatives

- Why indexes of alternative manager performance, think CTAs, aren't all that informative. (mrzepczynski.blogspot.com)

- Research shows just how much mutual funds have embraced investing in private companies. (alphaarchitect.com)

Behavior

- Evidence that well-being continues to increase with income well above the '$75,000 a year' threshold. (pnas.org)

- Financial concerns make workers less productive. (privpapers.ssrn.com)

- How higher pay can help increase productivity. (wsj.com)

Research

- Despite a surge in indexing, the markets are getting more efficient, not less. (alphaarchitect.com)

- The low vol effect is present, and strong, in China. (papers.ssrn.com)

- The basics of momentum investing. (blog.validea.com)

- Using ML to identify predictive price patterns. (papers.ssrn.com)

- Research shows female CFOs are less likely to fudge the numbers. (alphaarchitect.com)