Wednesdays are all about personal finance here at Abnormal Returns. You can check out last week’s links including a look at whatever happened to leading personal finance app Mint.

Quote of the Day

"Instead of trying to second guess those prices, you could make your first step just accepting them as the market’s best estimate of future returns and then build your portfolio around them, without trying to time the market or bet against it."

(Robin Powell)

Chart of the Day

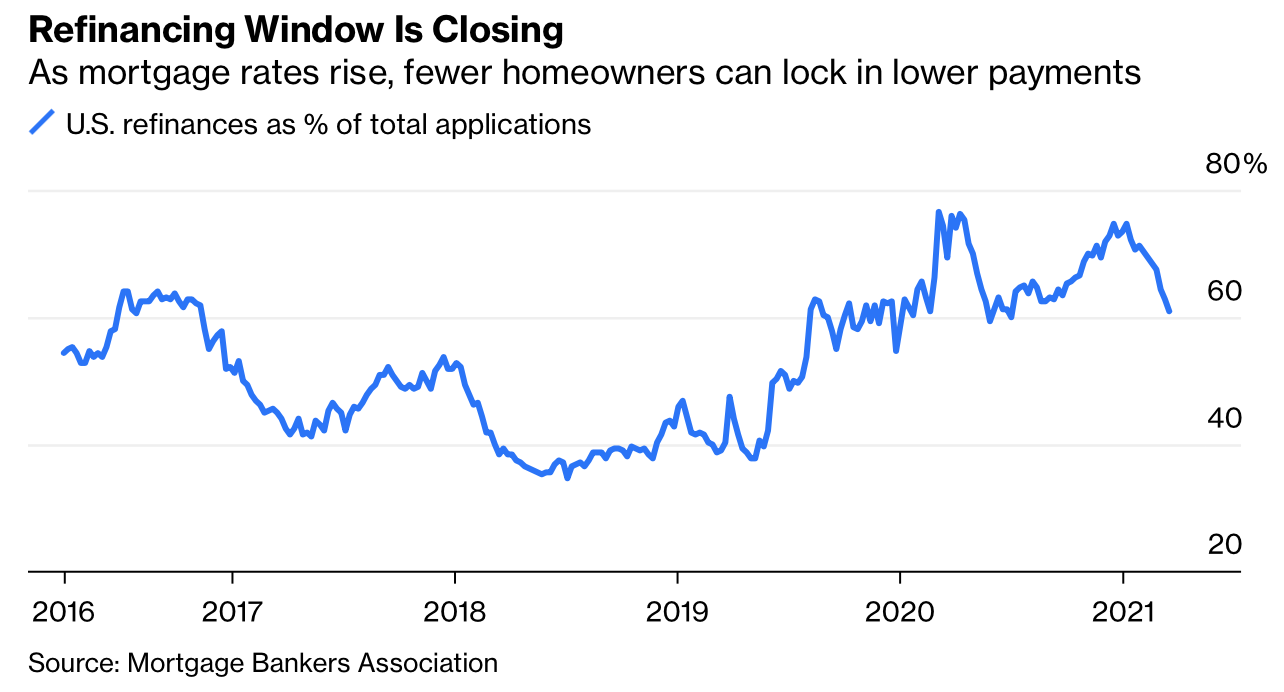

The mortgage refinancing window is closing for more American homeowners.

FIRE

- FIRE isn't for everyone. (ofdollarsanddata.com)

- Saira Rahman and Megan McShane discuss what it takes to achieve financial freedom. (podcasts.apple.com)

Financial anxiety

- Financial strains can have a real impact on your health and psyche. (gq.com)

- Being poor can create financial anxiety for life. (wewantguac.com)

Crypto

- Paypal ($PYPL) now allows you to pay for stuff with crypto. (coindesk.com)

- The question is should you? There are tax implications when transacting in crypto. (twitter.com)

Retirement savings

- How to make up for lost time if you got a slow start on retirement saving. (awealthofcommonsense.com)

- Save, don't spend, your pandemic cash to make for a better retirement. (bloomberg.com)

Spending

- Jacob Schroeder, "Spend money freely on the things that matter most to you. At the same, slash costs unrelentingly on all the things that don’t." (incognitomoneyscribe.com)

- Not wanting something is as good as having it. (theescapeartist.me)

Saving

- Emergency savings accounts are viewed as the next benefit to accompany workplace retirement plans. (investmentnews.com)

- Can you realistically save 30% of your income? (humbledollar.com)

Investing

- What you need to know about how interest rates affect bond prices. (bankeronwheels.com)

- ETF investors would do well to focus on the broad-based, low cost core funds. (evidenceinvestor.com)

Personal finance

- Teaching kids about money is a balancing act. (humbledollar.com)

- Income is the first step to building meaningful wealth. (awealthofcommonsense.com)

- CPI numbers only take you so far - your mileage may vary. (morningstar.com)

- How to use QLACs, or Qualified Longevity Annuity Contracts, to offset longevity risk. (humbledollar.com)

- 2020 IRA contribution deadlines have moved to May 17th as well. (cnbc.com)

- There's really no downside to keeping good financial records. (peterlazaroff.com)

- For your financial health get yourself a password manager. (humbledollar.com)