Quote of the Day

"History suggests that oversupply is a reliable way to end a collectible boom."

(James Surowiecki)

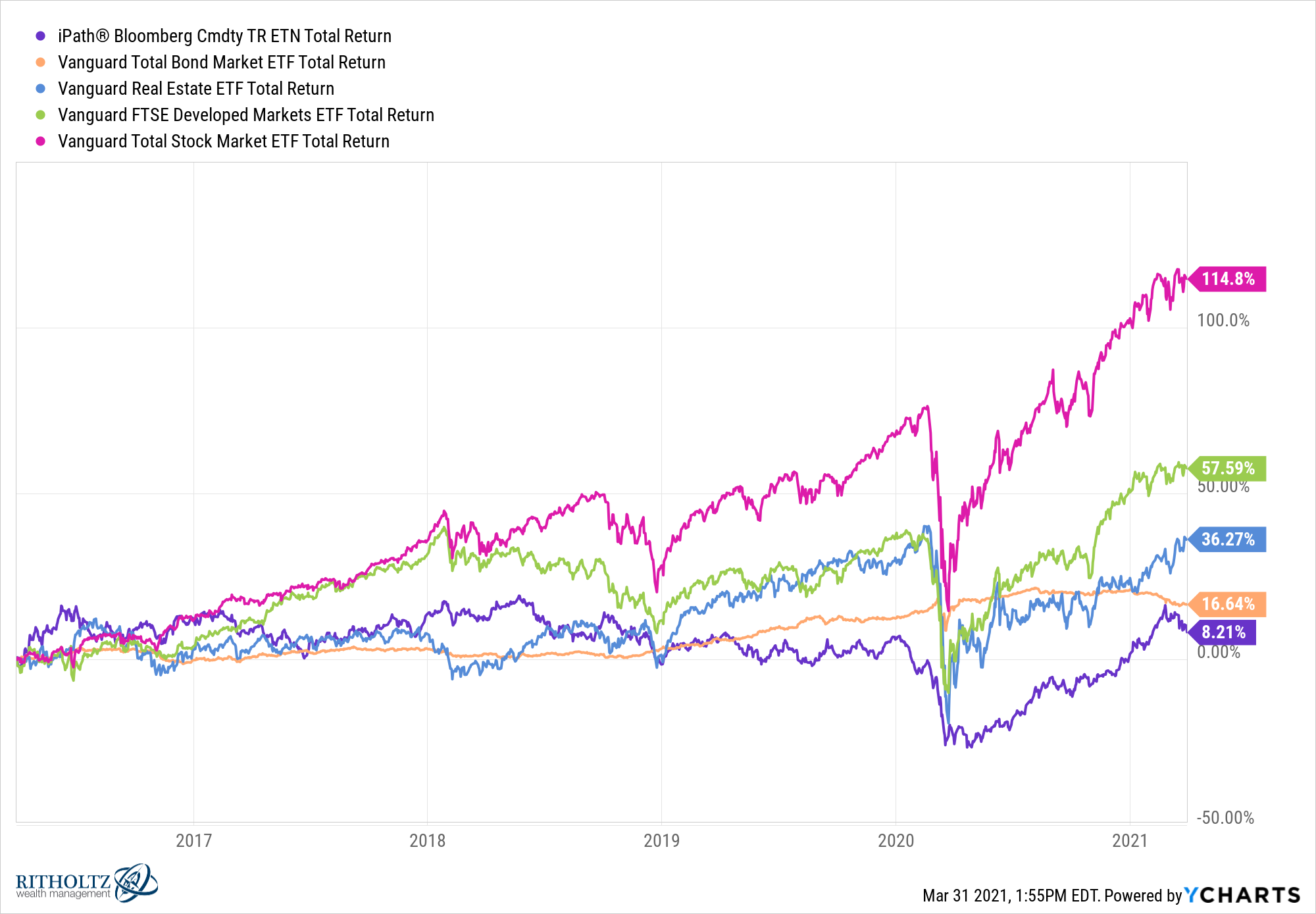

Chart of the Day

Even after a rally, commodities are still the worst-performing asset class over the past five years. (chart via @ycharts)

Yield

- 10-year Treasury yields are back to January 2020 levels. (ft.com)

- The muni market outperformed Treasuries in Q1. (bnnbloomberg.ca)

Bull markets

- Historically stock market crashes have been relatively rare during economic booms. (awealthofcommonsense.com)

- Some bull market misconceptions. (ritholtz.com)

Blow-ups

- Aaron Brown, "Not every credit loss is a mistake or a disaster. They are a natural part of the financial system." (bloomberg.com)

- The Archegos Capital blow up shows that we don't really know how much leverage is in the system. (howardlindzon.com)

Crypto

- Why would you use Bitcoin to transact if you think it's value is going higher? (bloomberg.com)

- Why crypto investors need to be aware of what constitutes a taxable transaction. (allaboutyourbenjamins.com)

Big Tech

- Is Amazon's ($AMZN) private label business different than other retailers efforts? (ben-evans.com)

- Apple ($AAPL) has invested in independent music distribution company UnitedMasters. (techcrunch.com)

- Google ($GOOGL) is still expanding its office space footprint. (businessofbusiness.com)

SPACs

- SPAC IPO pops are no longer a thing. (wsj.com)

- SPAC deals don't happen on any sort of schedule, just ask Bill Ackman. (institutionalinvestor.com)

- Investment banks are struggling to work through a backlog of SPAC filings. (bloomberg.com)

- A proposed fix to keep SPAC sponsors on board longer. (nytimes.com)

Global

- A second lost Summer will crush many European tourist spots. (ft.com)

- Amsterdam is putting in restrictions to blunt any post-pandemic tourism surge. (nytimes.com)

Shipping

- The Ever Given has been freed, but the costs are still being added up. (nytimes.com)

- It's not just the Suez Canal. Los Angeles ports are backed up as well. (wsj.com)

Economy

- A reopened economy is going to affect businesses differently. (permanentequity.com)

- Consumer spending is driving the economy. (disciplinedinvesting.blogspot.com)

- Consumer price inflation and 'asset inflation' are two very different phenomena. (pragcap.com)

- There's still no sign of a slowdown in home price inflation. (calculatedriskblog.com)

Earlier on Abnormal Returns

- Personal finance links: second guessing prices. (abnormalreturns.com)

- What you missed in our Tuesday linkfest. (abnormalreturns.com)

- Research links: a fair worry. (abnormalreturns.com)

- Know matter where, or how, you publish you need to own access to your audience. (abnormalreturns.com)

- What you should do to maximize the sum total of your life experiences. (abnormalreturns.com)

- Are you a financial adviser looking for some out-of-the-box thinking? Then check out our weekly e-mail newsletter. (newsletter.abnormalreturns.com)