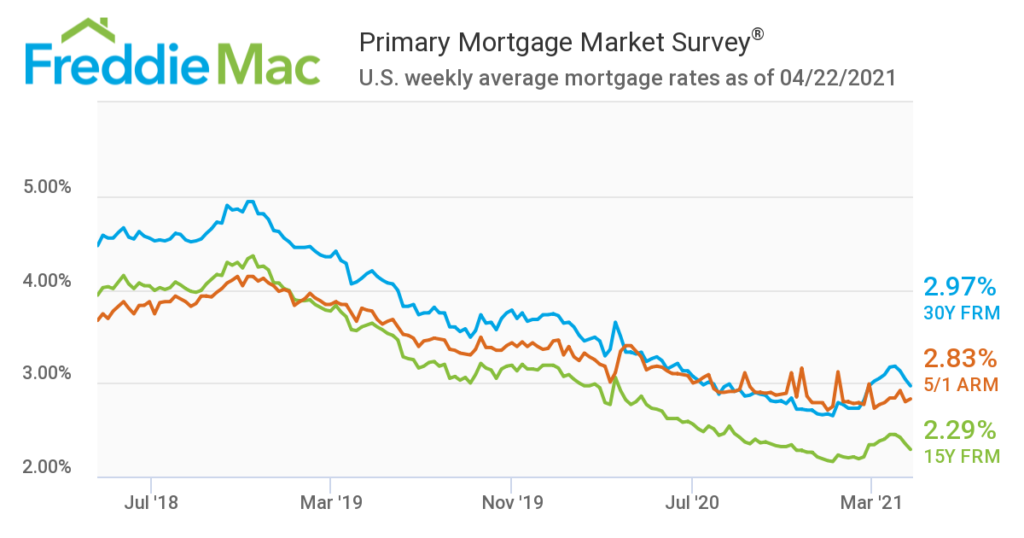

For the first time in a couple of months, 30-year mortgage rates are back below 3.0% according to the April 22, 2021 update from Freddie Mac.

The drop in mortgage rates is good news for homeowners who are still looking to take advantage of the very low rate environment. Freddie Mac research suggests that lower income and minority homeowners have been less likely to engage in the refinance market. Low and declining mortgage rates provide these homeowners the opportunity to reduce their monthly payment and improve their financial position.

Source: Freddie Mac

Count me as surprised. In January AND February I wrote about the opportunity to re-finance your mortgage. I figured a stronger economy would drive rates higher for awhile. While mortgage rates haven’t returned to those levels, I was still wrong! From an article by Alex Roha at Housing Wire:

According to data from Black Knight, a near 10-basis-point drop in mortgage rates can reinstate millions of borrowers in to “high-quality refinance candidate” status. After rates fell to 3.04% the week prior, Black Knight found the number of high-quality refi candidates moved back up to 13 million — potentially putting $3.6 billion back in to homeowners’ pockets.

Millions of home borrowers have another opportunity. It’s not news that the housing market is all manner of weird right now. But if you are planning to stay in your place for awhile you are getting a rare second chance at a lower mortgage rate.