Tuesdays are all about academic (and practitioner) literature at Abnormal Returns. You can check out last week’s links including a look at what really drives interest rates.

Quote of the Day

"So yes, flows may matter in the short, and maybe even the intermediate term. As Graham said, the market is a voting machine. But it eventually weighs."

(Drew Dickson)

Chart of the Day

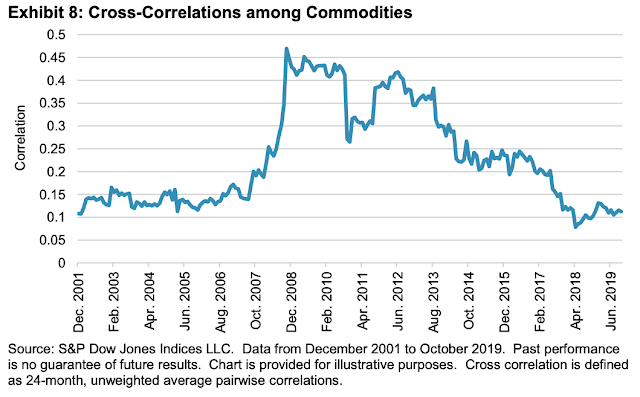

Commodity correlations have fallen back to levels not seen for a decade.

Institutional investors

- An impending divorce negatively affects investment performance. (wsj.com)

- Why are institutional investors better at buying than selling? (npr.org)

- How grit affects a portfolio manager's propensity to sell a security. (klementoninvesting.substack.com)

- Institutional investors really are different than individuals. (evidenceinvestor.com)

Behavior

- Why our intuition about exponential growth is so bad. (priceactionlab.com)

- We humans love additive solutions, not subtractive. (alphaarchitect.com)

Inflation

- Gold is too volatile to be a good inflation hedge. (wsj.com)

- Can you build a portfolio of equities that better proxies for inflation? (insights.factorresearch.com)

Research

- How much financial democratization is too much? (theblindfoldedchimp.com)

- How becoming a meme stocks can change its risk profile. (blogs.cfainstitute.org)

- Just how predictable are financial crises? (mailchi.mp)

- What's the future for quant equity now that factor investing seems played out? (caia.org)

- The active-passive debate is a false one. (alphaarchitect.com)