Tuesdays are all about academic (and practitioner) literature at Abnormal Returns. You can check out last week’s links including a look at the historic returns of SPACs.

Quote of the Day

"High-active-share funds are relatively expensive and have shown an undesirable risk profile over the long run."

(Robby Greengold)

Chart of the Day

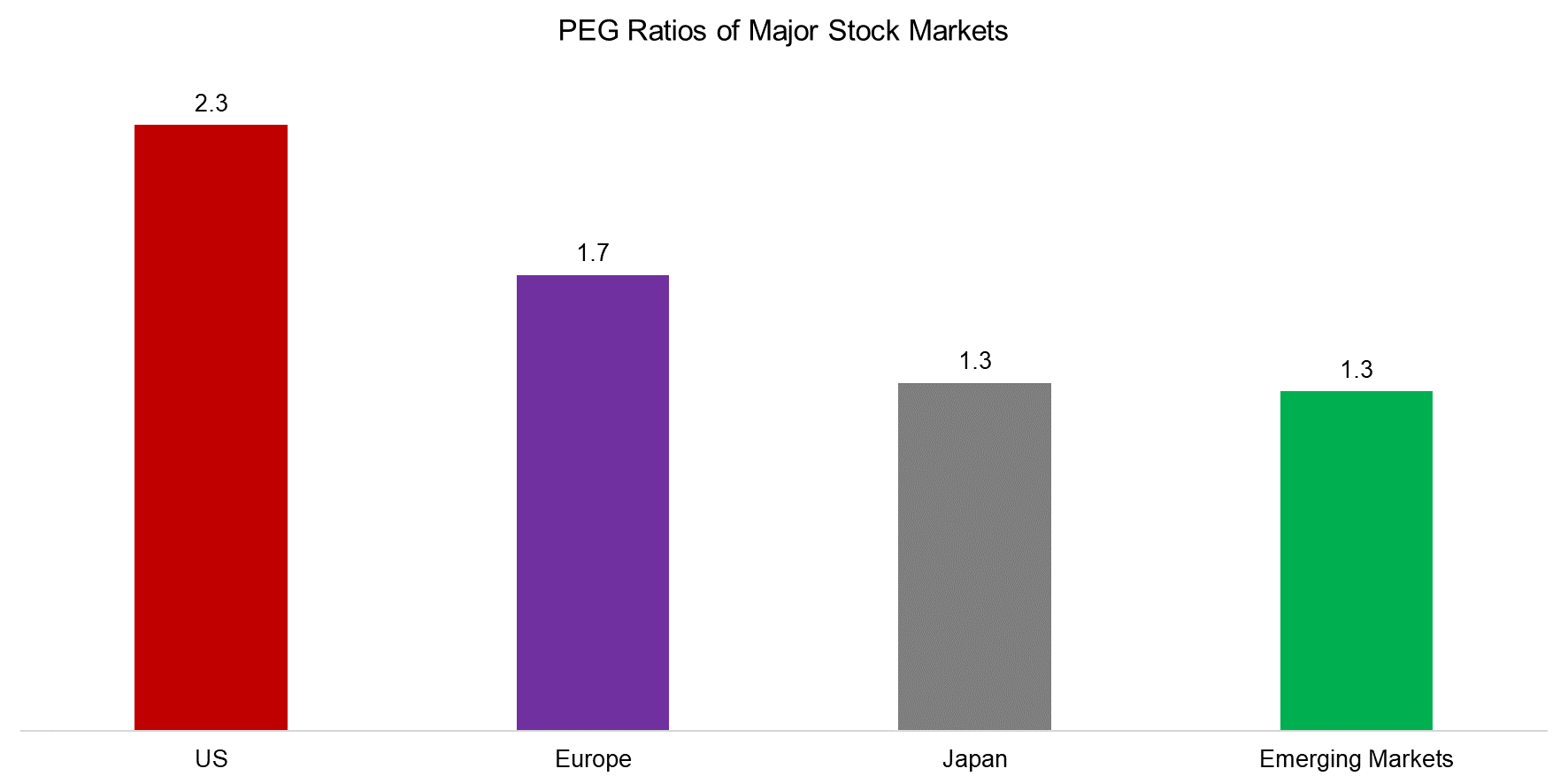

The U.S. stock market indeed does look expensive relative to the rest of the world.

Alternatives

- Richard Ennis, "U.S. equity market beta has been an important driver of return across the board — in public markets and private; in hedge funds; in real estate; in U.S. and non-U.S. equities; and in some segments of fixed income..." (institutionalinvestor.com)

- Why private equity replication has made little headway against the real thing. (bloomberg.com)

Factors

- Factor investors need to have a long time horizon to see a payoff. (evidenceinvestor.com)

- An overview of fundamental value strategies. (sr-sv.com)

- How to combine different momentum strategies. (quantpedia.com)

- Just because high beta has negative alpha doesn't low beta has positive alpha. (alphaarchitect.com)

Research

- Does the day of the month matter when it comes to implementing a tactical asset allocation strategy? (allocatesmartly.com)

- Cap-weighted indices aren't perfect, then again nothing is. (advisorperspectives.com)

- Is there a model for valuing digital currencies? (caia.org)

- What effect has fractional trading had on the stock market? (papers.ssrn.com)

- On the asymmetric risk of the forex carry trade. (mailchi.mp)