Quote of the Day

"You can shake your head at how big these companies are getting but they are big for a reason. The fundamentals more than back up their market caps."

(Ben Carlson)

Chart of the Day

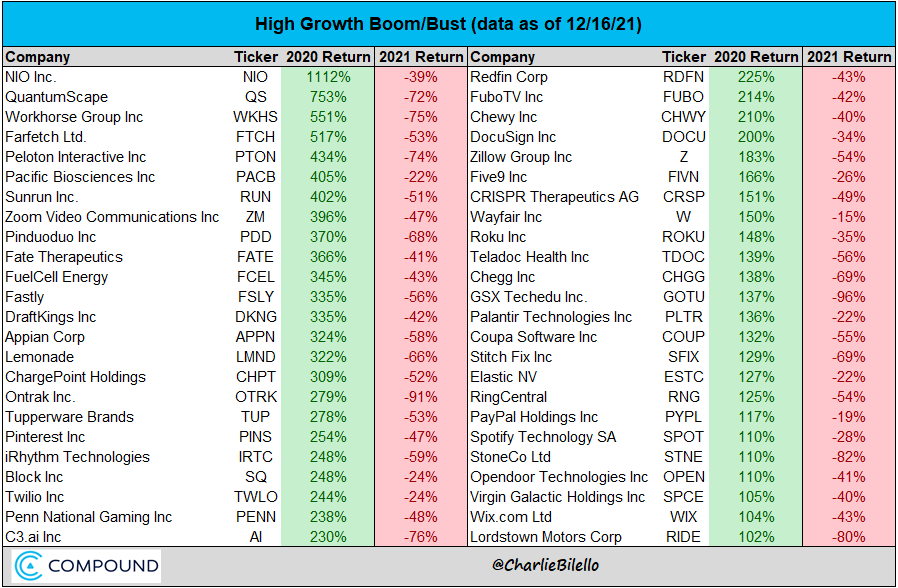

Some of the best performing stocks of 2020 have seen a turnaround this year.

Markets

- The market's biggest companies aren't there by accident. (awealthofcommonsense.com)

- Size was the defining equity market factor of 2021. (morningstar.com)

- Flush corporate pension funds are rebalancing into bonds. (ft.com)

Crypto

- Big Tech is seeing an exodus for crypto startups. (nytimes.com)

- Bitcoin ownership is highly skewed. (wsj.com)

- It's easy to forget crypto stuff is happening outside the U.S. (wired.com)

- How Axie Infinity works. (garbageday.email)

Venture

- VCs have not been shy about putting money into crypto startups. (bloomberg.com)

- The math behind venture capital fund returns. (insights.factorresearch.com)

- How to run an early-stage board meeting. (nfx.com)

Companies

- Oracle ($ORCL) is buying medical records company Cerner ($CERN). (cnbc.com)

- Carvana ($CVNA) is in no hurry to give up transactions with affiliated parties. (wsj.com)

ETFs

- 2021 was a boom year for ETF launches in the U.S. (bloomberg.com)

- A look the year in ETFs including a surge in actively managed funds. (etf.com)

- The big ETF providers continue to cut fees. (riabiz.com)

Supply chain

- Companies are having to re-think their global supply chains. (ft.com)

- Companies are innovating to get around this year's bottlenecks. (wsj.com)

Economy

- A lot of demand was pulled forward in pandemic, 2022 is to going to see some normalization. (avc.com)

- Falling savings rates will cause more people to re-enter the workforce. (wsj.com)

Earlier on Abnormal Returns

- Adviser links: inflation ignorance. (abnormalreturns.com)

- What you missed in our Sunday linkfest. (abnormalreturns.com)

- Top clicks last week on the site. (abnormalreturns.com)

- Are you a financial adviser looking for some out-of-the-box thinking? Then check out our weekly e-mail newsletter. (newsletter.abnormalreturns.com)

Mixed media

- The best (and worst) investment books of 2021 including "The Revolution That Wasn't" by Spencer Jakab. (advisorperspectives.com)

- Some investment books worthy of gifting including "Trillions: How a Band of Wall Street Renegades Invented the Index Fund and Changed Finance Forever " by Robin Wigglesworth. (monevator.com)

- Notes from "The Davis Dynasty" the story of Shelby Collum Davis and his family by John Rothchild. (novelinvestor.com)