Tuesdays are all about academic (and practitioner) literature at Abnormal Returns. You can check out last week’s links including a look at why hedge fund alpha has disappeared over time.

Quote of the Day

"Risk mitigation doesn’t always work the way you expect."

(Portfolio Charts)

Chart of the Day

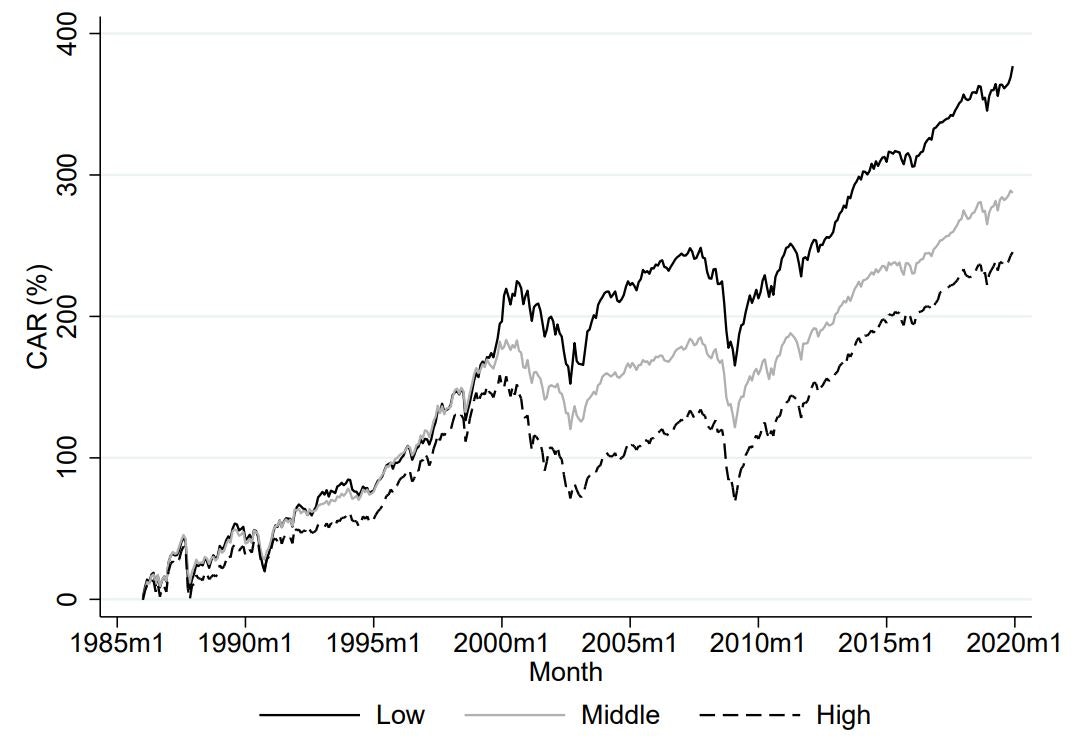

How companies that like to boost their capital spending in Q4 perform.

Research

- An optimal allocation to a risky asset may decline with expected returns. (elmwealth.com)

- Value does not seem to be associated with changes in interest rates. (alphaarchitect.com)

- How companies that like to boost their capital spending in Q4 perform. (klementoninvesting.substack.com)

- Political beliefs do help predict fund manager behavior. (papers.ssrn.com)

- The percentage of COO, CCO, and CTO roles that women fill in the global marketplace. (alphaarchitect.com)

- Does parental risk-taking affect their children's stock market behavior? (papers.ssrn.com)