Quote of the Day

"The numbers are in: 2021 was the most profitable year for American corporations since 1950."

(Matthew Boesler)

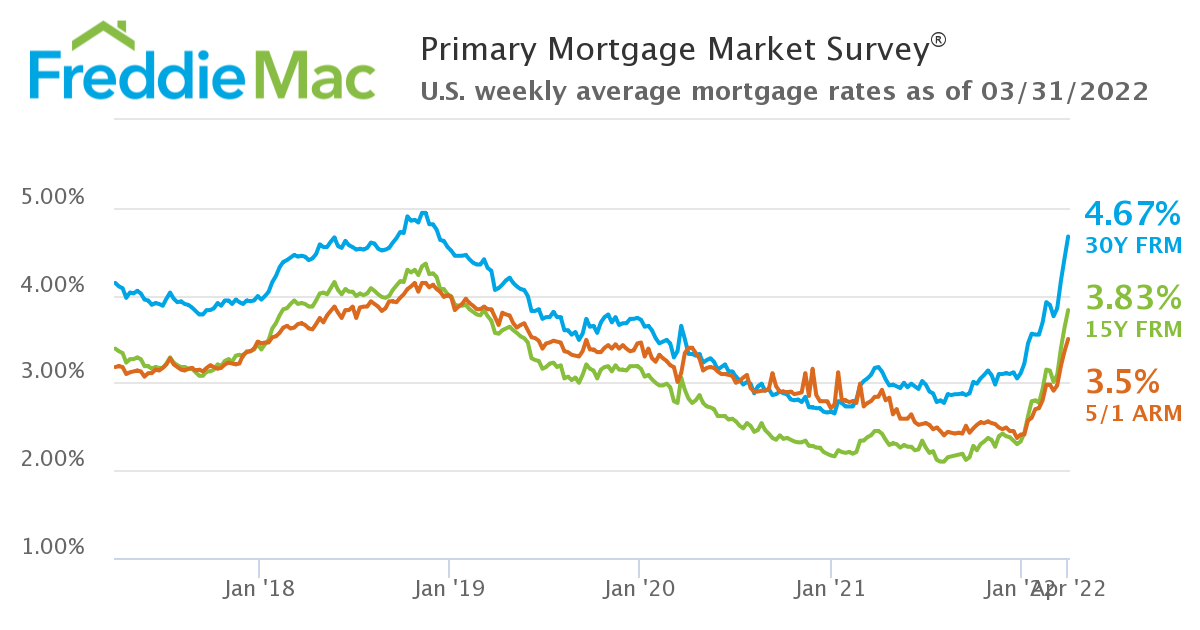

Chart of the Day

Mortgage rates have hit their highest level since 2018. (chart via Freddie Mac)

Strategy

- On the importance of position sizing. (novelinvestor.com)

- Why it's always 'wait 'til next year' for stock pickers. (humbledollar.com)

Funds

- Why fund managers need to be as careful picking their investors as they do their investments. (albertbridgecapital.com)

- Please don't confuse ETNs with ETFs. (blog.etfthinktank.com)

Crypto

- The crypto industry has amassed an impressive amount of support in Washington DC. (ft.com)

- OpenSea is struggling to keep up with massive user growth. (fortune.com)

Finance

- New SEC rules are going to put the hurt on new SPAC issuance. (institutionalinvestor.com)

- Bill Ackman plans to downshift his activist style. (ft.com)

Startups

- Softbank is slowing its investment pace in light of recent setbacks. (ft.com)

- A look at how the pandemic affected venture capital funding. (news.crunchbase.com)

- Chief, a private network designed to help more businesswomen rise into positions of power, just became a unicorn. (news.crunchbase.com)

- Is a downturn in the private markets ever a systemic risk? (doomberg.substack.com)

Economy

- Jobless claims are hanging around at historically low levels. (bonddad.blogspot.com)

- The Fed has had a hard time pulling off 'soft landings' historically. (economist.com)

- Diesel prices are taking the brunt of the rise in crude oil. (nytimes.com)

- Are rising mortgage rates really going to put a dent in home prices? (nytimes.com)

Earlier on Abnormal Returns

- Longform links: the illusion of safety. (abnormalreturns.com)

- What you missed in our Wednesday linkfest. (abnormalreturns.com)

- Personal finance links: simple portfolios. (abnormalreturns.com)

- Are you a financial adviser looking for some out-of-the-box thinking? Then check out our weekly e-mail newsletter. (newsletter.abnormalreturns.com)