Quote of the Day

"The most damaging situation for investors is where we take decisions with the intention of enhancing our performance, but don’t acknowledge or accept the negative aspects that we will have to endure to achieve it."

(Joe Wiggins)

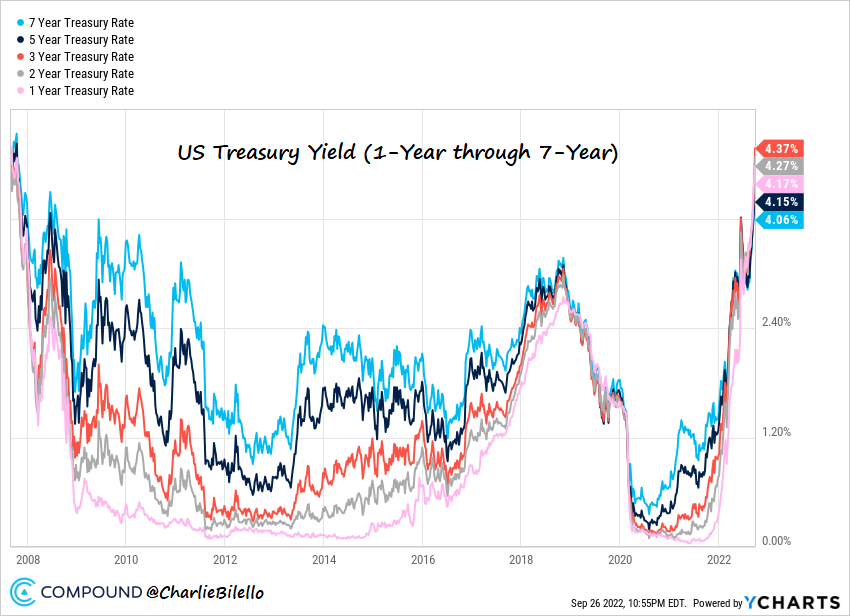

Chart of the Day

The yield on the 1-7 year Treasury notes are now all above 4%. (via @charliebilello)

Rates

- Yields on cash equivalents are rising rapidly. (wealthmanagement.com)

- Rapidly rising real interest rates provide competition for stocks. (capitalspectator.com)

- Expected returns on bonds are finally attractive. (awealthofcommonsense.com)

Markets

- Lumber prices are back down to pre-pandemic levels. (wsj.com)

- Don't fight the last war: this isn't 2008. (theirrelevantinvestor.com)

- Are stocks cheap yet? It depends... (morningstar.com)

FTX

- FTX won the auction to buy the assets of bankrupt (coindesk.com)

- FTX.US Brett Harrison is stepping down. (theblock.co)

Fund management

- How the big private equity firms are going after individual investors. (institutionalinvestor.com)

- The actively managed ARK Venture Fund is now live. (cnbc.com)

- Why the Vanguard U.S. Liquidity Factor ETF (VFLQ) is getting liquidated. (riabiz.com)

- Why it's tough to be an aging hedge fund manager. (efinancialcareers.com)

Global

- Only one country, Japan, still has any debt with negative yields. (compoundadvisors.com)

- China is seeing falling home prices. (theguardian.com)

Economy

- The July Case-Shiller numbers shows a deceleration in home prices. (calculatedrisk.substack.com)

- The CFNAI is not yet signalling a recession. (econbrowser.com)

- Higher mortgage rates are going to crush the housing market. (pragcap.com)

Earlier on Abnormal Returns

- Research links: a stock market constant. (abnormalreturns.com)

- What you missed in our Monday linkfest. (abnormalreturns.com)

- Adviser links: changing relationships. (abnormalreturns.com)

- Are you a financial adviser looking for some out-of-the-box thinking? Then check out our weekly e-mail newsletter. (newsletter.abnormalreturns.com)