Tuesdays are all about academic (and practitioner) literature at Abnormal Returns. You can check out including a look at ‘submergence risk’ as a better measure of risk.

Chart of the Day

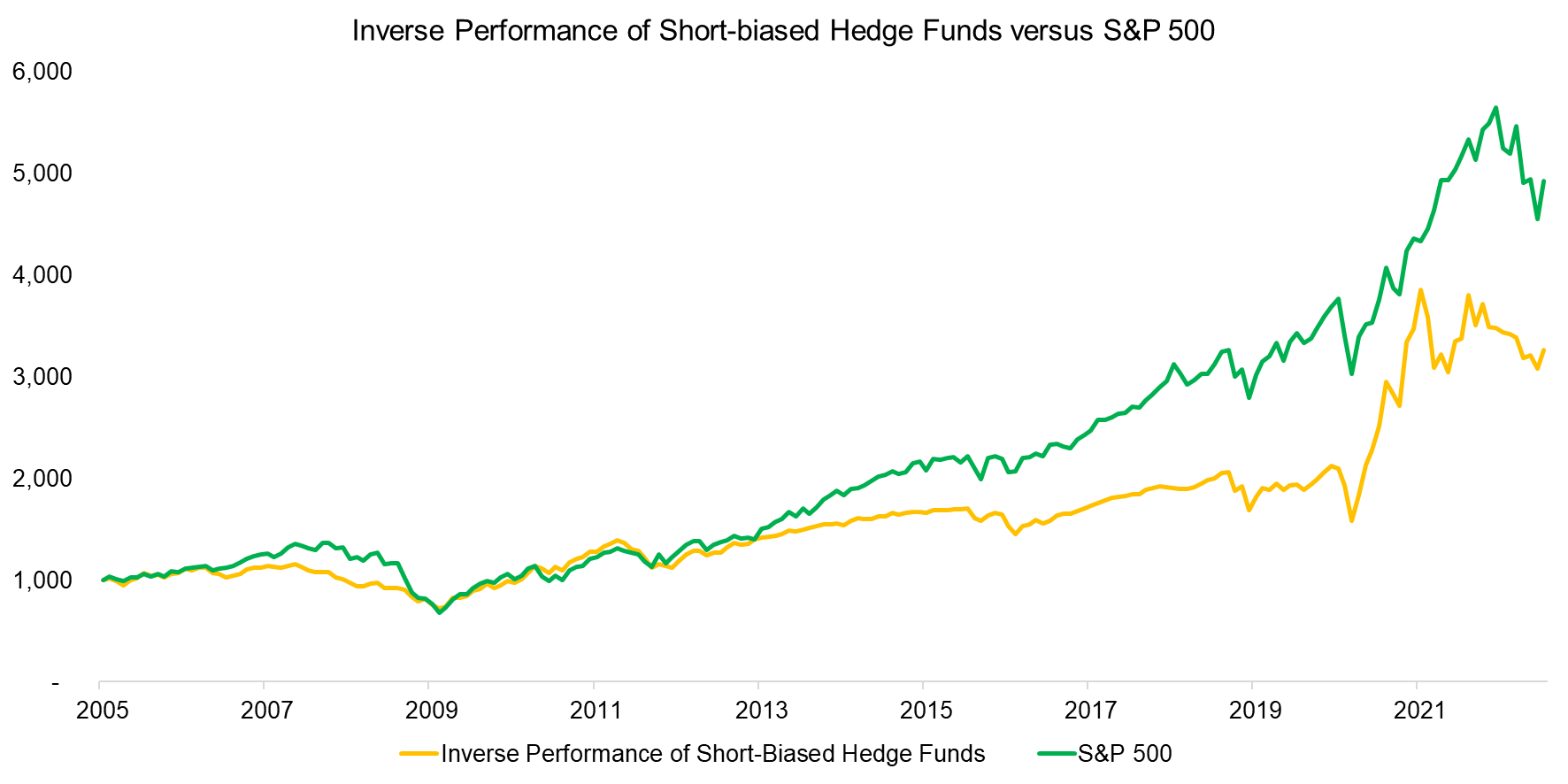

The track record of short-biased hedge funds is not great.

Corporate finance

- Spinoffs, on average, outperform their parent companies a year out. (marketwatch.com)

- "Cost of Capital: A Practical Guide to Measuring Opportunity Cost" by Michael Mauboussin and Dan Callahan. (peterlazaroff.com)

Quant stuff

- Why does the mainstream media highlight technical analysis? (mathinvestor.org)

- If an AI model is a true black box, can investors justify it's use? (institutionalinvestor.com)

- How to use ChatGPT to fill out RFPs. (institutionalinvestor.com)

- Are Google data useful for economic forecasting? (econbrowser.com)

Research

- Does international diversification still work? (tandfonline.com)

- Value stocks still have room to outperform. (alphaarchitect.com)

- What have we learned about managed futures in the last year? (mrzepczynski.blogspot.com)

- Bitcoin has not become 'digital gold.' (papers.ssrn.com)

- Retail options trading is a net loser. (advisorperspectives.com)