Quote of the Day

"A large drawdown does not signify a past bubble."

(Mark Rzepczynski)

Markets

- Earnings and interest rates are going to battle it out in 2023. (klementoninvesting.substack.com)

- There's no free lunch in small cap stocks. (ofdollarsanddata.com)

- Why covered call funds ultimately disappoint. (morningstar.com)

Companies

- For Amazon ($AMZN), it's live by the employee stock-compensation, die by the employee stock-compensation. (wsj.com)

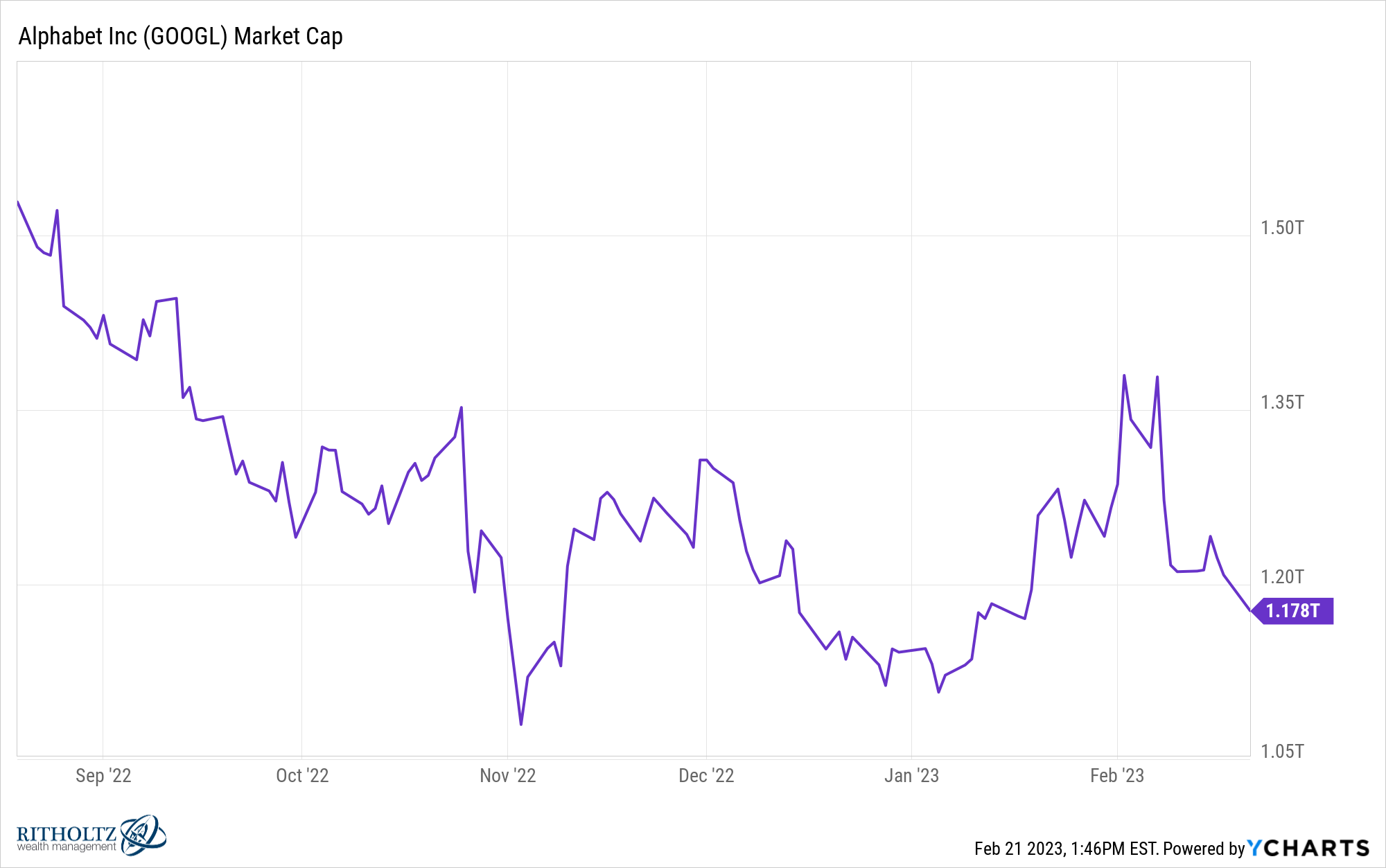

- Today's Google ($GOOGL) is no longer the innovative organization it used to be. (medium.com)

- Why Pat Gelsinger's job at Intel ($INTC) is so tough. (mondaynote.com)

Hedge funds

- Bridgewater Associates paid a high price to get Ray Dalio to retire. (nyti.ms)

- There are way more hedge funds than Burger Kings in the world. (on.ft.com)

Finance

- Blackrock ($BLK) is benefiting from flows into bond ETFs. (ft.com)

- VCs are having a tougher time raising new capital. (wsj.com)

Economy

- Low locked-in mortgage rates are going provide stimulus for awhile. (awealthofcommonsense.com)

- What does history say about the prospects of a soft landing. (mrzepczynski.blogspot.com)

- The decline in home prices is somewhat orderly. (thebasispoint.com)

Earlier on Abnormal Returns

- Research links: retail options trading. (abnormalreturns.com)

- Do less to do better. (abnormalreturns.com)

- Adviser links: swapping video for audio. (abnormalreturns.com)

- What you missed in our Sunday linkfest. (abnormalreturns.com)

- Are you a financial adviser looking for some out-of-the-box thinking? Then check out our weekly e-mail newsletter. (newsletter.abnormalreturns.com)