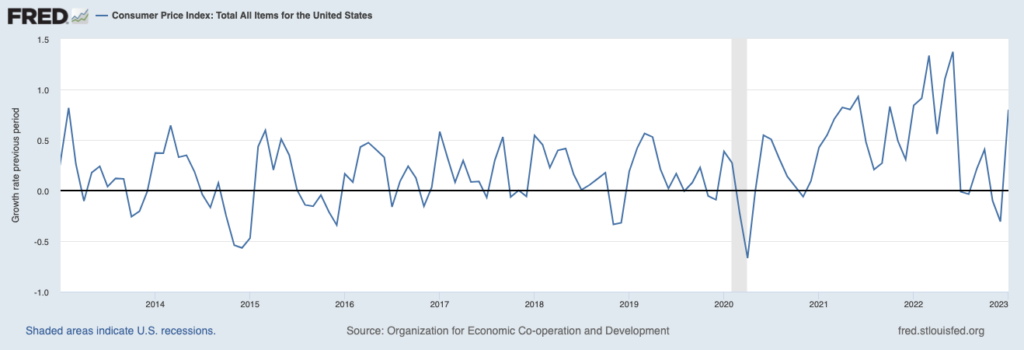

Inflation has been the biggest topic in the economy for the past two years or so. So it is not surprising there have been a raft of articles telling you how to save money in this environment.

One area we could audit our subscription pending is on media, including books. Thankfully there is a resource that can help us out: the public library. I am a fan of using the the library to listen to audiobooks, but there is a lot more available to the public.

Shara Tibken writing in the Wall Street Journal writes about the growing importance of digital resources in today’s public library. Depending on what you are looking for you may be able to find it via your library card. Tibken writes:

Freebies vary from library to library, but several things are broadly available—such as ebooks, audiobooks, videos and educational apps. Check your branch’s website or app to figure out exactly what you can get. And don’t forget that other library systems, some of which have richer resources, can also give you a card.

There is no such thing as free books or free news. You are already paying either directly or indirectly for your local library through some sort of tax. So it only makes sense to take advantage of what it has to offer.

That doesn’t mean everything is okay amidst the bookshelves. The major publishers, of which there are only a handful left, are not making it easy for libraries to lend e-books and audiobooks to their patrons. This is short-sighted because making it easy for readers to get their hands on books will only make them better, more dedicated, readers down the road.

In a world where the number of third spaces in which we can gather are on the decline, public libraries stand out as an exception. The provision of all these digital resources by the library is great, it still makes sense to step foot in your library from time to time. You never know what you may find.