Quote of the Day

"Good investors understand that bear markets and volatility are part of where returns come from; these long-term investors have learned that riding them out is their highest probability approach."

(Barry Ritholtz)

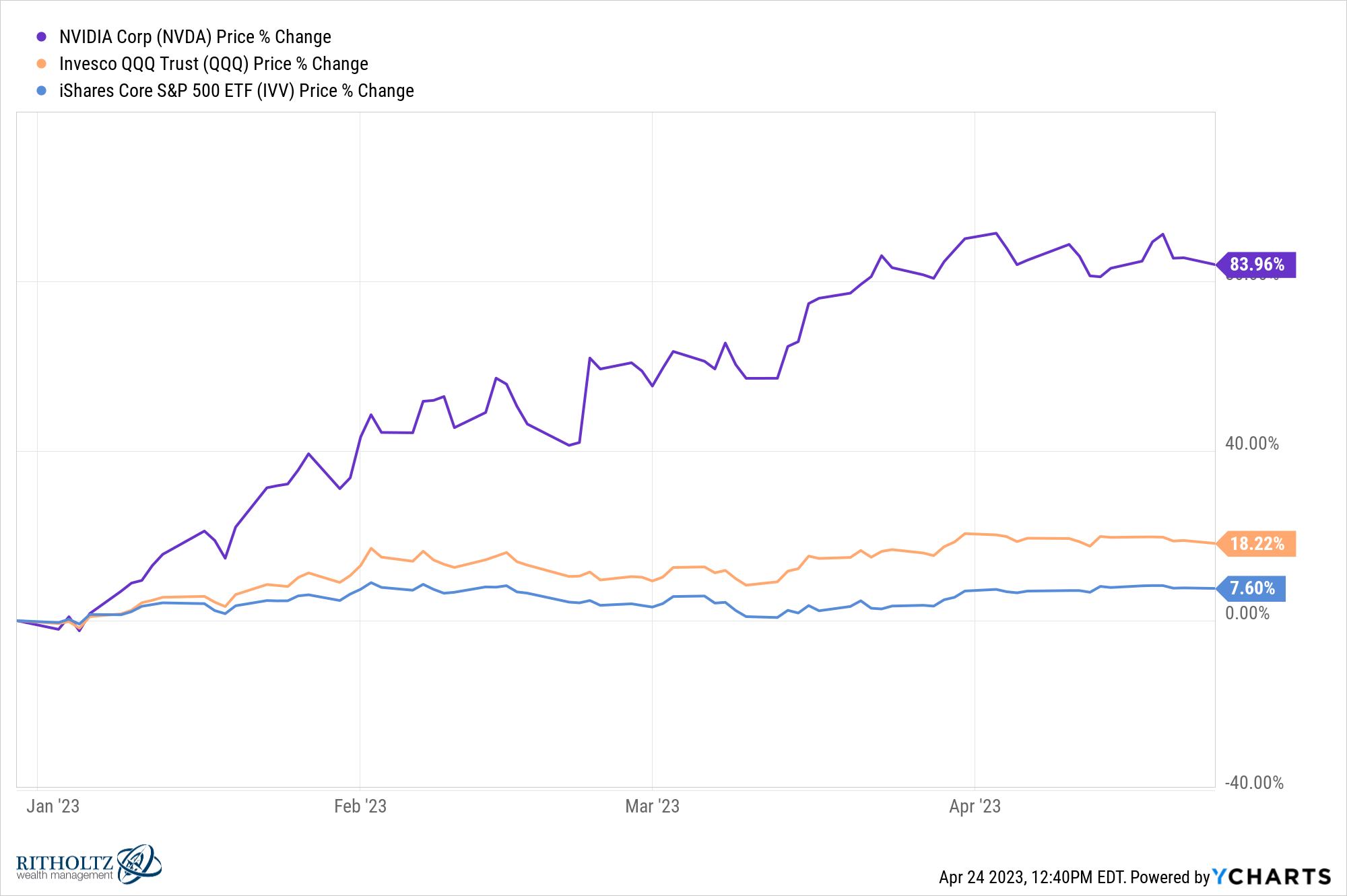

Chart of the Day

AI hype has pushed Nvidia ($NVDA) stocks to the top of the S&P 500 performance list, YTD. (chart via @ycharts)

Markets

- There is now a one-day version of the VIX. (finance.yahoo.com)

- European stocks are trading at a discount to the U.S. (mailchi.mp)

- Some hard-core crypto types have turned to precious metals. (wsj.com)

- Why are investors so nervous? (allstarcharts.com)

Strategy

- What happens after a big down year in the stock market? (awealthofcommonsense.com)

- Just knowing that stocks go through cycles matters. (dariusforoux.com)

- Recency bias is the bane of investors. (advisorperspectives.com)

Finance

- Why the demise of Silicon Valley Bank shouldn't have been surprising. (ft.com)

- Don't discount Apple's ($AAPL) push into financial services. (macworld.com)

- Twitter has stopped funding VCs it has committed to. (forbes.com)

Economy

- The American consumer is getting more cautious. (thereformedbroker.com)

- Income tax withholdings are in decline. (bonddad.blogspot.com)

- A soft landing doesn't mean there aren't bumps along the way. (vox.com)

Earlier on Abnormal Returns

- Adviser links: vulnerable later in life. (abnormalreturns.com)

- What you missed in our Sunday linkfest. (abnormalreturns.com)

- Top clicks last week on the site. (abnormalreturns.com)

- Are you a financial adviser looking for some out-of-the-box thinking? Then check out our weekly e-mail newsletter. (newsletter.abnormalreturns.com)