Tuesdays are all about academic (and practitioner) literature at Abnormal Returns. You can check out including a look at the case for factor timing.

Quote of the Day

"Markets are also noisier, more dynamic and more adversarial than many other realms where AI is being deployed."

(Robin Wigglesworth)

Chart of the Day

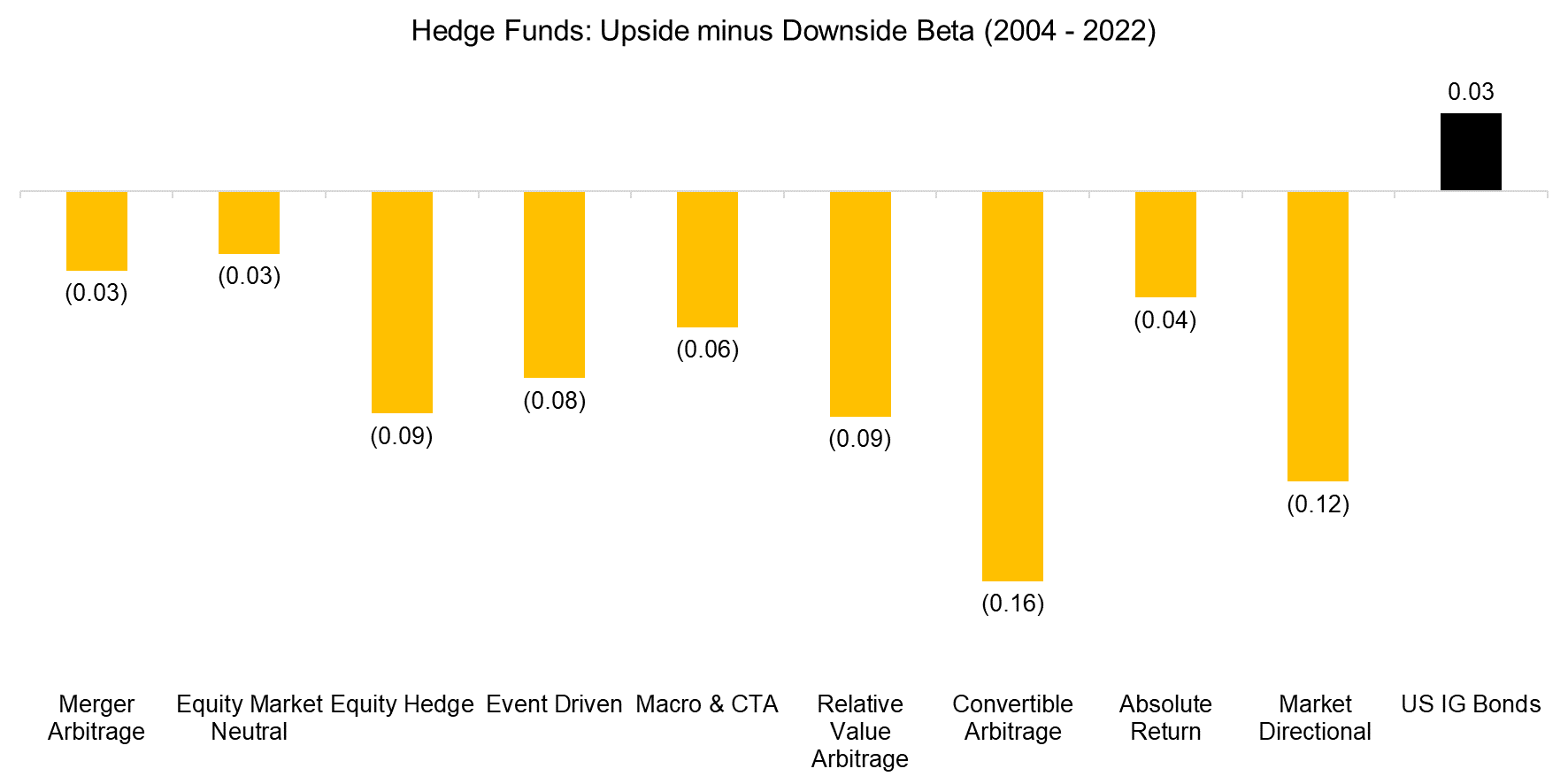

Asset classes can have different upside and downside betas.

IPOs

- Do VC-backed IPOs outperform? It depends on if the VCs stick around. (papers.ssrn.com)

- The track record for SPACs isn't great. (advisorperspectives.com)

Mutual funds

- Expense ratios do a good job of sorting mutual fund performance. (morningstar.com)

- Active funds with the lowest fees tend to outperform high cost counterparts. (advisorperspectives.com)

- Comparing the performance of team-managed and single-manager hedge funds. (klementoninvesting.substack.com)

Corporate finance

- How stock-based compensation became a large majority of executive pay. (morganstanley.com)

- Companies repurchase significantly more shares when they expect higher future earnings relative to market expectations. (papers.ssrn.com)

Research

- Of course quality investors should take intangible assets into account. (institutionalinvestor.com)

- How do social networks affect asset markets? (alphaarchitect.com)

- Why high frequency trading programs fail in practice. (papers.ssrn.com)

- Following crypto-influencers generated negative returns over time. (papers.ssrn.com)

- Value-driven investors, i.e. ESG, still want to outperform. (papers.ssrn.com)