Tuesdays are all about academic (and practitioner) literature at Abnormal Returns. You can check out including a look at the difference between long-short and long-only factor return strategies.

Quote of the Day

"The responsible voice in our head tells us that a strategy of doing nothing can’t possibly work. Yet, markets repeatedly upend our expectations, which we often form by attempting to decode recent events and their future implications."

(Jeff Ptak)

Chart of the Day

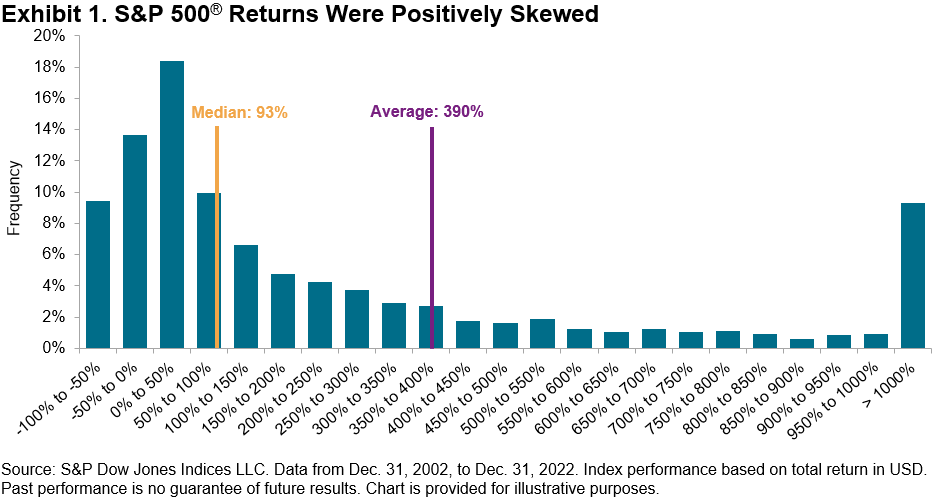

Skewed returns put concentrated portfolios at risk of underperformance.

Quant stuff

- The difference between the Spearman and Pearson coefficients. (mrzepczynski.blogspot.com)

- Traders often come up with a strategy and then try to justify it. (priceactionlab.com)

Factors

- Factors aren't forever. How exposure decay over time. (alphaarchitect.com)

- The case for factor timing. (institutionalinvestor.com)

Equity risk premium

- More evidence that the vast majority of stock market returns come from a handful of stocks. (papers.ssrn.com)

- A new model that derives the equity risk premium from the options markets. (papers.ssrn.com)

Research

- Holding gold comes at a cost. (papers.ssrn.com)

- On building more capital efficient portfolios. (blog.thinknewfound.com)

- How a 5% pullback happens matters for future returns. (papers.ssrn.com)

- How investor sentiment drives IPO returns. (papers.ssrn.com)

- Does firsthand experience make for better performance? (papers.ssrn.com)

- What really drives ESG investing behavior. (papers.ssrn.com)