Tuesdays are all about academic (and practitioner) literature at Abnormal Returns. You can check out last week’s edition including a look at the historical returns to structured notes.

Quote of the Day

"To predict more effectively, you need algorithms that approach the problem from many different directions. To do that, you need model builders who think creatively and data sets that offer as many different perspectives on a problem as possible. Scale is essential."

(Igor Tulchinsky and Christopher E. Mason)

Chart of the Day

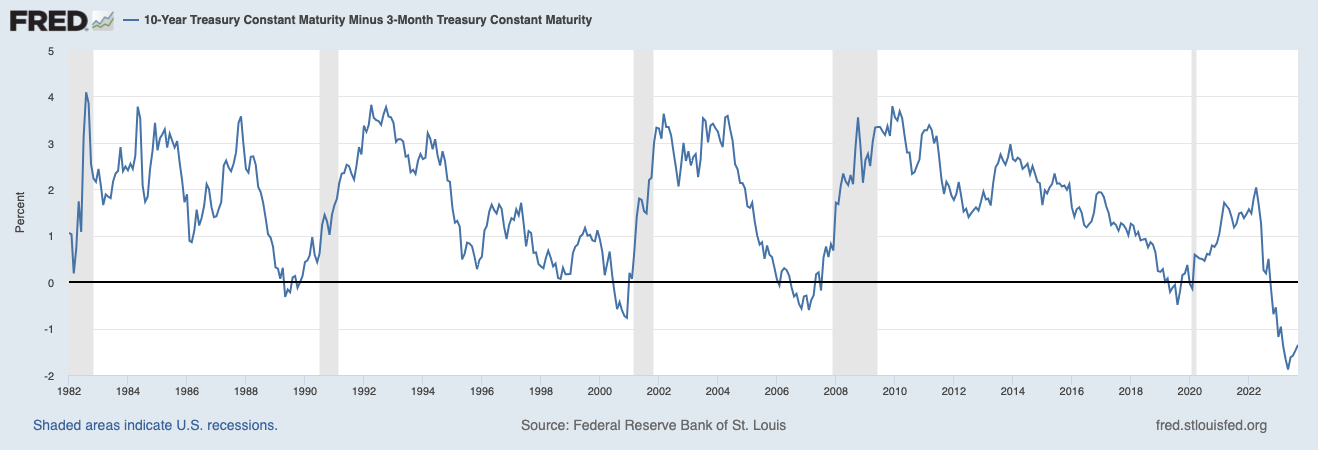

The 10 year-3 month Treasury yield spread has been inverted for a long time now. (chart via FRED)

Research

- A closer look at the investment factor. (alphaarchitect.com)

- Does investment skill transfer across asset classes? (papers.ssrn.com)

- How fee salience helped drive down mutual fund fees. (papers.ssrn.com)

- Why bond momentum has been largely ignored. (optimalmomentum.com)

- Are corporate bond yields correlated with ESG scores? (blogs.cfainstitute.org)

- An excerpt from "Age of Prediction, Algorithms, AI, and the Shifting Shadows of Risk" by Igor Tulchinsky and Christopher E. Mason. (institutionalinvestor.com)

- A round-up of recent research into financial crises. (capitalspectator.com)

- The battle for a Citadel internship is fierce. (bloomberg.com)