Sometimes you need to take an idea to its illogical end to show you the absurdity of it. For quite some time now I have been writing about the proliferation of ETFs, or the “ETFization of everything.” Which on the whole has been a boon for investors. However the ETF is still happy to create products based on hot trends or a favorable backtest.

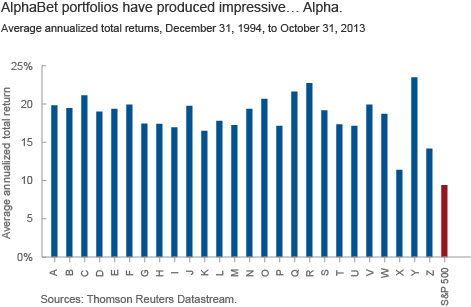

Joel Dickson at Vanguard Advisor did a little data exercise creating “AlphaBet portfolios” that in a backtest showed uniform outperformance relative to the S&P 500 over a ten year period. The only hitch is that the strategy being used, an alphabetical one by ticker symbol, should have no bearing on price performance.

Source: Vanguard Advisor

Dickson rightly notes that the outperformance of these portfolios was driven by the inherent small cap bias of this strategy over this time period. He also notes that narrowly constructed indices and favorable historical backtests are designed to “anchor expectations for future performance.” Investors therefore need to look at this kind of marketing data with a jaundiced eye.

John Rekenthaler at Morningstar recently noted that the wave of so-called “smart beta” products is simply driven by weightings toward small caps and value. Neither of which are either new or particularly novel. History has been kind to both of these factors but investors should go into any investment with an understanding of the drivers of future fund performance in mind.

“Gimmicky ETFs” are nothing new. The above exercise is a good one because it highlights how even a patently absurd strategy can in a backtest look perfectly profitable. Investors therefore need to arm themselves with the knowledge to understand the construction of new and prospective ETFs. In short, just because some firm can put something into an ETF wrapper does not mean that you shouldn’t take a closer look.

Update: The Attain Capital blog had a good post up last month on the “hard issues” facing anyone dealing with backtested results.