‘Tis the season. Marc Levinson’s The Box: How the Shipping Container Made the World Smaller and the World Economy Bigger ended up on Bill Gates’ list of the top seven books of 2013.

Quote of the day

John Rekenthaler, “A sophisticated, mathematical version of buying high and selling low is sophisticated and mathematical–but it loses money just the same.” (Rekenthaler Report)

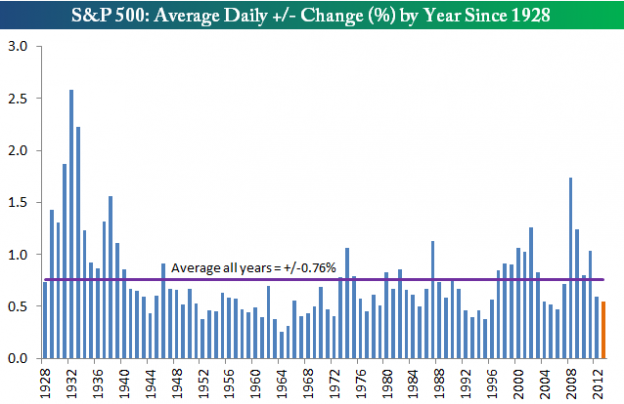

Chart of the day

2013 saw equity market volatility ebb. (Bespoke)

Markets

The case for reflationary assets. (Market Anthropology)

Wall Street’s best trades of 2013. (Quartz)

We are now in the historically best time of the year for the stock market. (Crossing Wall Street, Ryan Detrick)

There’s more to valuation than the Shiller CAPE ratio. (The Reformed Broker)

There is still plenty of room for global payout ratios to rise. (FT Alphaville)

Hedge funds are warming to the opportunity in CMBS. (NetNet)

Companies

The stock market’s surge has put corporate pension funds back on a more solid footing. (WSJ)

Why Google ($GOOG) wins. (Howard Lindzon)

The bear case for Manchester United. ($MANU). (Dealbook)

Spotify is now free on mobile. (Pando Daily, The Verge)

Finance

VCs are now betting big on the Bitcoin universe. (Dealbook)

Estimating private equity returns from LP cash flows. (SSRN)

Have NYC taxi medallion holders finally met their match? (Felix Salmon)

Hedge funds

On the downfall of John Taylor’s FX Concepts hedge fund. (aiCIO)

The drop is gold is putting pressure on Sprott Inc. (WSJ)

Sears Holdings ($SHLD) aside Eddie Lampert is doing alright. (II Alpha)

Herbalife ($HLF) is trying to hit Bill Ackman where it hurts. (Buzzfeed Business)

Funds

Is low-vol now a crowded trade? (Focus on Funds)

Vanguard is now in the low vol fund game. (Vanguard)

The ETF Deathwatch for December 2013. (Invest with an Edge)

Some marquee open-end funds are closing their doors. (InvestmentNews)

Economy

Stanley Fischer is the presumed new No. 2 at the Fed. (Wonkblog, WSJ, Businessweek)

Will low inflation derail the taper? (Capital Spectator)

Weekly initial unemployment claims (and retail sales) surge. (Calculated Risk, ibid)

Iowa farmland values hit a record high. (Businessweek)

Earlier on Abnormal Returns

What you may have missed in our Wednesday linkfest. (Abnormal Returns)

Stuff

The Apple Macbook Air is still the best laptop out there. (Paste)

A gift guide for the traders, investors and analysts in your life. (Barry Ritholtz)

Behold the Christmas sweater industrial complex. (Quartz)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.