Quote of the day

John Rekenthaler, “Active management has never been in worse repute. This is the darkest of days.” (Marketwatch)

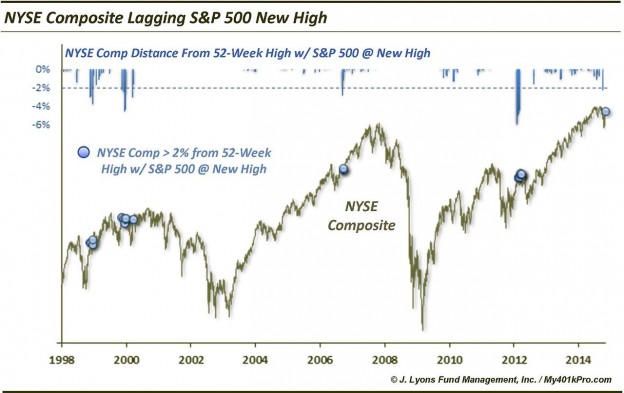

Chart of the day

The broader market is lagging this rally. (Dana Lyons)

Markets

October asset class performance. (Bespoke)

Short volatility is a crowded trade. (The Felder Report)

Keep an eye on the relative performance of high yield bonds. (Humble Student)

Strategy

The problem with precious metals stocks: feast or famine. (A Wealth of Common Sense)

Why MLP seasonality matters. (SL Advisors)

Why historically the 3rd year of the Presidential election cycle has been positive. (The Fat Pitch)

Companies

Liability matching: why Apple ($AAPL) is borrowing in Euros. (Bloomberg)

Walt Disney ($DIS) got Apple and Google ($GOOG) to agree on movie distribution. (WSJ)

Finance

Where did all the big buyouts go? (Dan Primack)

Are buybacks a travesty, or smart capital allocation? A Q&A with William Thorndike author of The Outsiders: Eight Unconventional CEOs and Their Radically Rational Blueprint for Success. (HBR)

On the long history (and disappointments) of virtual currencies. (FT Alphaville)

Funds

Despite the hype mutual fund assets still tower over the $2 trillion in ETFs. (WSJ)

A Q&A with David Snowball of Mutual Fund Observer fame. (WSJ)

On the difference between minimum vol and low vol ETFs. (Monevator)

A look at the big developed market ETFs. (ETF)

Economy

It is hard to get excited about the economic prospects for Europe. (Real Time Economics, Quartz)

House prices are up 5.6% year over year. (Calculated Risk)

Earlier on Abnormal Returns

What books Abnormal Returns readers purchased in October 2014. (Abnormal Returns)

What you might have missed in our Monday linkfest. (Abnormal Returns)

Mixed media

Amazon Prime now allows you to store an unlimited number of photos. (GigaOM)

Uber is changing the way people party in Los Angeles. (NYTimes)

How Sonos built the perfect speaker for streaming music. (Businessweek)

You can support Abnormal Returns by visiting Amazon or follow us on StockTwits, Yahoo Finance and Twitter.