Quote of the day

Mick Weinstein, “Strong money managers are constantly working on their process, questioning it, listening to others for insight, and tweaking it as they go.” (Covestor)

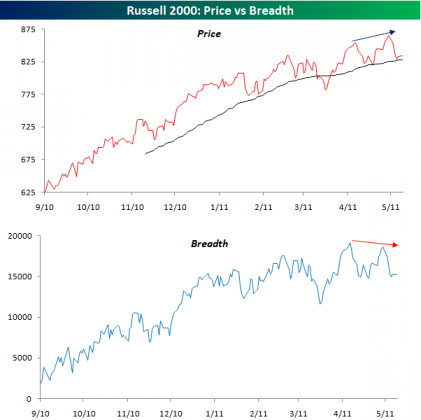

Chart of the day

Small caps are at a critical juncture. (Bespoke)

Markets

Using the ISM index to invest. (Pragmatic Capitalism)

Great companies don’t always make great stocks. (Bespoke)

Last week aside, the oil boom is not necessarily over. (UpsideTrader)

QE2 is ending. Buy bonds. (WSJ)

Here is one commodity that is in a bear market: onions. (Real Time Economics)

Strategy

Don’t sell in May. Switch in May. (EconomPic Data)

Is there any seasonality in gold and gold miners? (CXO Advisory Group)

Fundamentals only get you so far. (Market Anthropology)

How Nelson Peltz invests. (CNNMoney)

A long-long pairs trade. (Investing With Options)

On the importance of stepping away from the trading screen. (SMB Training)

Companies

LinkedIn sets the tone as the first among social media IPOs. (24/7 Wall St., GigaOM also Herb Greenberg)

Can Groupon pivot its business model prior to a much anticipated IPO? (CNNMoney)

Bad timing for an AIG (AIG) share offering. (WSJ)

The law of diminishing returns hits Wal-Mart (WMT). (research puzzle pix)

Apple

Who needs a living room when there is an iPad? (Howard Lindzon)

Apple (AAPL) is the most valuable brand in the world. (Bloomberg, Apple 2.0, Forbes)

Among other things Apple is a particularly efficient company. (Asymco)

Funds

More free ETF trades coming via Global X and Interactive Brokers. (IndexUniverse)

When should you fire your fund manager? (WashingtonPost)

Active management is the new buy-and-hold. (InvestmentNews)

Finance

Barry Ritholtz, “The surviving Dodo Bird Bankers are an unnatural blasphemy on Capitalism. Their continued existence undermines faith on our laws, institutions, and economy.” (Big Picture)

Should we tax high frequency trading? (Atlantic Business)

Don’t worry about the CEOs, they did just fine last year. (WSJ)

Global

Is emerging market inflation that out of whack? (beyondbrics)

Can a country have too much in the way of currency reserves? (voxEU)

Economy

Tim Duy, “The Fed believes Q1 weakness was temporary.” (Economist’s View)

The Fed has very little effect on housing at the moment. (Fortune)

The home price double dip is here. (WSJ, Fund My Mutual Fund, Money Game)

US households continue to deleverage. (Carpe Diem)

Has the stock market fully incorporated a slowdown in economic growth? (Capital Spectator)

More on the resurgence in the US manufacturing economy. (Bloomberg)

Uncle Sam is putting some assets up for sale. (Planet Money, Marginal Revolution)

Econ bloggers are nothing if not uncertain about the US economy. (Kauffman, FT Alphaville)

Earlier on Abnormal Returns

What you missed in our Monday morning linkfest. (Abnormal Returns)

Megacaps are cheaper than they have ever been. Is summer their time to shine? (AR Screencast)

Mixed media

Phil Pearlman, “There’s a big difference between reporting the news and making money.” (Phil Pearlman)

StockTwits and CNNMoney announce a content partnership. (StockTwits Blog)

Abnormal Returns is a founding member of the StockTwits Blog Network.