Quote of the day

Francesco Guerrera, “Activism investing is just another way to try to beat the market by picking undervalued stocks. The difference is that activists don’t wait for the market to recognize a company’s value, they try to make things happen on their own terms.” (MoneyBeat)

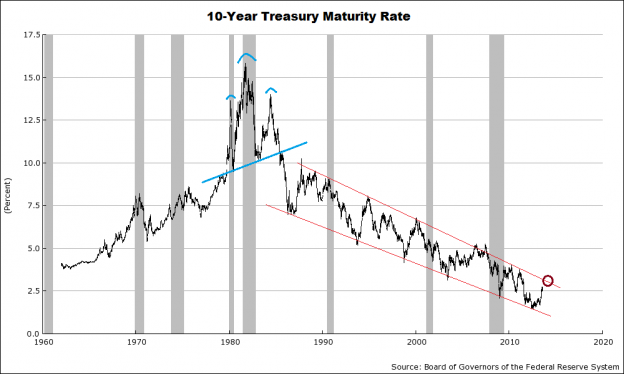

Chart of the day

Bond yields are breaching some long standing trendlines. (Vconomics)

Bonds

The bond market fears Larry Summers. (Felix Salmon)

Bonds still have a ways to fall to enter an official bear market. (Bespoke)

Three ways to look at bond yields. (Bonddad Blog)

Why higher real yields are a good thing. (Calafia Beach Pundit)

Markets

A look at the mixed technical picture. (Charts etc.)

A field guide to stock market corrections. (The Reformed Broker)

Ten high conviction picks from the ultimate stock pickers. (Morningstar)

Strategy

TI, “Passive index fund investing is logically right, but emotionally and in terms of common sense, it often feels wrong.” (Monevator)

Why you need to come to the markets with “no bias and no set agenda.” (Brian Lund)

Are CTAs broken? (All About Alpha)

What should “real-time contrarians” be doing with their portfolios. (Capital Spectator)

More does not necessarily mean better. How constraints make life better. (Bucks Blog)

Companies

ExxonMobil ($XOM) cannot get out of its own way. (chessNwine)

What’s next for Cisco ($CSCO)? (Pando Daily)

The biggest acquirer you have never heard of. (Term Sheet)

Finance

The South Dakota Retirement System is “sneaky awesome at what it does.” (Institutional Investor)

Will investors swap ETFs for “motifs“? (BIC)

Are ‘SAFE plans’ a better way to save for retirement? (Wonkblog)

ETFs

Has the low volatility anomaly disappeared? (CBS News)

The upside of having more fundamental-weighted ETFs. (IndexUniverse)

The AdvisorShares TrimTabs Float Shrink ($TTFS) has crushed the market YTD. (IBD)

Emerging markets

Emerging market inflation-linked bonds have gotten especially hard hit. (FT)

Get used to emerging market volatility. (MoneyBeat)

Some signs of hope for emerging market investors. (Business Insider, MoneyBeat)

Economy

The Chicago Fed National Activity Index shows continued below trend growth. (Calculated Risk, Capital Spectator)

Why investors should ignore economists. (Daily Ticker)

Home prices in the desert are looking bubbly again. (Bloomberg)

No other Fed chairman has had a lower inflation rate than Ben Bernanke. (FT Alphaville)

On the economic impact of big data. (GigaOM)

Earlier on Abnormal Returns

What you may have missed in our Tuesday linkfest. (Abnormal Returns)

Mixed media

Media brands no longer sell out they “sell in.” (Daniel Gross)

The Tesla Model S just got the best safety rating in NHTSA history. (Slate, Business Insider)

The ultimate cheat sheet for starting and running a business. (James Altucher)

Nassim Taleb’s five tips for “having a great day.” (Business Insider)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.