Quote of the day

John Authers, “There are too many hedge funds. ” (FT)

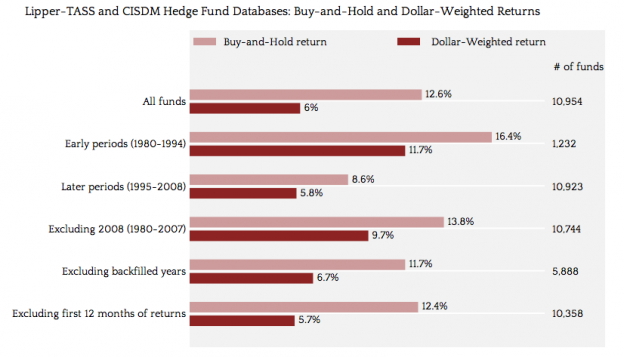

Chart of the day

Why we should look at dollar-weighted returns. (Verisi Data Studio via Practical Quant)

Markets

Major asset class performance for January 2012. (Capital Spectator)

Performance-wise 2012 is the complete opposite of 2011. (Bespoke, Stock Sage)

2011 was a tough year for commodities hedge funds. (FT)

Yields just keep on compressing. (Economic Musings)

Is the VIX tail wagging the implied volatility dog? (FT Alphaville)

Stop worrying about the Baltic Dry Index, instead pay attention to iron ore prices. (Sober Look)

ZIRP

Suck it, savers. Things are tough all over. (Money Game)

Is “financial repression” good for stocks? (MarketBeat)

The many ways in which an extended period of low rates can distort the economy. (FT)

Strategy

Where one TAA model sits going into February. (MarketSci Blog)

On the importance of humility in investing. (Vanguard Blog)

What is risk and why it matters. (Tradestreaming)

Almost all trading blowups are preventable. (SMB Training)

The market seems to react differently to share repurchases from small and large firms. (SSRN via CXOAG)

Companies

The market loves companies that initiate a dividend. (Dynamic Dividend)

Procter & Gamble ($PG) is a quality company that looks to be fully priced. (Turnkey Analyst)

Wintel is a cash cow. (YCharts Blog)

With its huge cash hoard should Apple ($AAPL) reinvent the way gadgets are manufactured? (Slate)

Finance

Investigators are getting closer to figuring out where MF Global’s cash went. (Dealbook)

Is Andreesen Horowitz too smart for its own good? (peHUB, Time)

Janus Capital ($JNS) is a “cautionary tale.” (research puzzle pix)

Why do investors hire financial advisers? (Registered Rep)

Hedge funds

The carried interest debate and high-frequency trading hedge funds. (TNR)

The principal-agent problem and alternative asset managers. (Qfinance)

Does the average hedge fund investor make money? (Minyanville)

ETFs

Select Sector SPDRs will not be undersold. (IndexUniverse)

ETN holders should keep an eye on CDS rates. (IndexUniverse)

Global

China’s PMI ticked up in January. Soft landing anyone? (FT contra Money Game)

The global manufacturing PMI is at a seven-month high. (Global Macro Monitor)

Another problem for Euro banks: shipping loans. (Zero Hedge)

Economy

The ISM manufacturing report shows continued expansion in January. (Calculated Risk, MarketBeat)

The ADP report shows continued private payroll growth. (Calafia Beach Pundit, MarketBeat)

By another measure the unemployment rate hasn’t budged. (FT Alphaville)

A look at long term money growth. (A Dash of Insight)

All eyes turn to the budget deficit in….2013. (Pragmatic Capitalism)

Things are looking up for restaurants. (Calculated Risk)

What leading economic bloggers are thinking. (Kauffman Foundation)

Earlier on Abnormal Returns

A pre-filing Facebook IPO linkfest. (Abnormal Returns)

What you missed in our Wednesday morning linkfest. (Abnormal Returns)

Mixed media

Who should learn to program? (Chris Dixon)

The world needs a Netflix ($NFLX) for books. (The Atlantic)

Abnormal Returns is a founding member of the StockTwits Blog Network.