Quote of the day

Brett Steenbarger, “Mindfulness will not substitute for sound trading strategies with an edge, but it is difficult to imagine maximizing an edge without self-awareness and self-control. ” (TraderFeed)

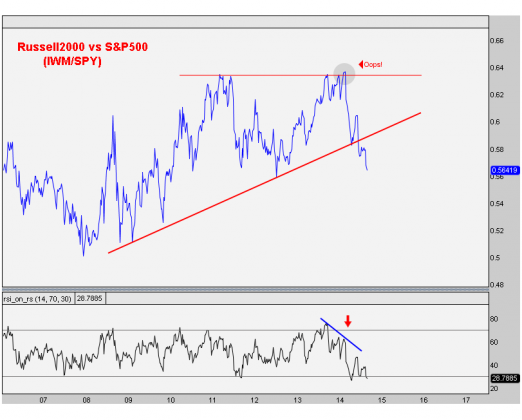

Chart of the day

Small caps are at a 2 year low relative to large caps. (All Star Charts)

Markets

The US Dollar is at a key juncture. (Market Anthropology, Ryan Detrick)

Silver continues to work off the froth from its 2011 top. (Syncubate, Short Side of Long)

Strategy

When share buybacks add to shareholder value and when they don’t. (Musings on Markets)

Corporate insiders are on a buying strike. (Bloomberg)

Chances are you don’t understand hedge fund strategies. (Bucks Blog)

Tech stocks can be value stocks. (Millennial Invest)

Companies

Alibaba ($BABA) could buy Yahoo ($YHOO) for free. (Matt Levine also WSJ)

Given all the risk factors why would anyone buy Alibaba? (John Cassidy)

Dollar stores are getting pinched from both sides these days. (NYTimes)

Finance

Should you buy bank stocks leading up to a Fed rate increase? (Bloomberg also Irrelevant Investor)

The Treasury is pushing back against tax inversion deals. (WSJ, Fortune)

Wall Street firms are rethinking their exposure to Russia. (Dealbook)

Bond traders are looking for alternate careers. (Bloomberg, FT)

Institutional investors

Why do long-term investors need to hedge? (Barry Ritholtz also Capital Spectator)

Institutional investors are doing hedge funds wrong. (Ashby Monk)

Institutional investors are inadvertently over-diversifying their portfolios. (Focus on Funds)

The argument against hedge fund fees is now mainstream. (MoneyBeat)

ETFs

When to buy a stock and when to buy an ETF. (ETF)

When ETF issuers have to offer their wares for free. (ETF)

Global

German companies are on an acquisition tear. (Dealbook)

China’s hard landing is not here yet. (Gavyn Davies)

Economy

Inflation expectations are plummeting. (Economic Musings)

The case that wages will soon be on the rise. (AlphaNow)

The Chicago Fed National Activity Index ebbed in August. (Calculated Risk)

Home prices have retraced much of what they have lost since 2008. (Real Time Economics)

Why haven’t low interest rates led to increased capital expenditures? (FT Alphaville)

Earlier on Abnormal Returns

What you might have missed in our Monday linkfest. (Abnormal Returns)

Mixed media

Do you want rats (literally) to manager your money? (Marginal Revolution)

American made movies are becoming increasingly jumpy. (Flowing Data via @ftalpha)

You can support Abnormal Returns by visiting Amazon or follow us on StockTwits, Yahoo Finance and Twitter.