You can keep up with all of our posts by signing up for our daily e-mail. Thousands of other readers already have. Don’t miss out!

Quote of the day

Eddy Elfenbein, “When you’re investing in a company, you’re really investing in human ingenuity—the way that people can come together and figure out how to make something useful from those assets.” (Crossing Wall Street)

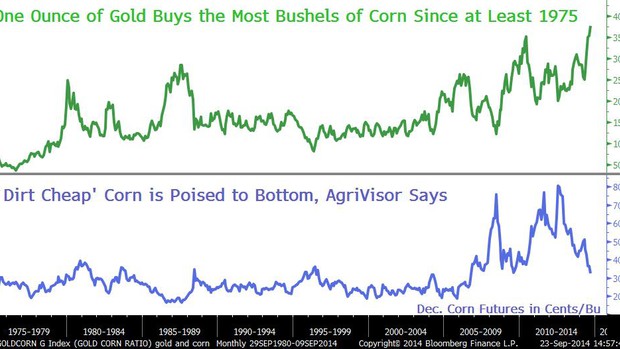

Chart of the day

Agricultural commodities are still getting crushed. (Bloomberg also Business Insider)

Markets

295 S&P 500 companies reduced their share count in Q2. (MoneyBeat)

Why is the yield curve flattening? (Dr. Ed’s Blog also Econbrowser)

Commodities

An investment in gold is a bet against human ingenuity. (Pragmatic Capitalism)

Commodity markets are paying now for the previous decade of hype. (Mark Dow)

Strategy

Tom Brakke, “What is the half-life of an investment theme? Of an investment theory? Of an investment belief?” (the research puzzle)

Have lower transaction costs been a boon or a bust for investors? (Morgan Housel als0 Vox)

Under what conditions do low vol strategies underperform? (SSRN via CXOAG)

Jason Voss, “The key intuition skill is non-attachment.” (Enterprising Investor)

Three lessons from a career near-miss. (A Wealth of Common Sense)

Corporate finance

Just about everyone thinks CEOs are paid too much. (HBR)

“Maximizing shareholder value” is a managerial choice not a legal obligation. (Enterprising Investor)

Would lower corporate taxes actually help stock prices? (Humble Student)

Finance

Calpers exit from hedge funds was more about Calpers than it was about hedge funds. (Dealbook)

If there is a VC bubble blame the pension funds. (Businessweek)

How the Yale University endowment did last year. (NYTimes)

2&20 is on the way out. (Pragmatic Capitalism)

REITs are trying to focus their portfolios. (WSJ)

Companies

Wal-Mart ($WMT) is going to offer low-cost checking. (Marketwatch, Fortune)

NYSE: 1, Nasdaq 0. (Pando Daily)

Funds

How much capacity do ‘smart beta‘ strategies have? (FT)

The active/passive debate is largely about cost. (Pragmatic Capitalism)

A closer look at Charles Schwab’s ($SCHW) commission-free ETFs. (ETF)

Pricing bonds is not an exact science. (WSJ)

Economy

A look at the centrality of housing to the US business cycle. (FT Alphaville)

More signs of real growth including trucking and chemicals. (Calafia Beach Pundit, Calculated Risk, ibid)

The subprime auto lending boom is not yet a bubble. (Real Time Economics)

What explains the success of Thomas Piketty’s Capital in the Twenty-First Century? (The Atlantic)

Earlier on Abnormal Returns

What you might have missed in the Tuesday linkfest. (Abnormal Returns)

Mixed media

The smart home needs a hub, enter Wink. (The Verge)

Your next doctor visit may be virtual. (Fortune)

Is automation making us stupid? A look at Nicholas Carr’s The Glass Cage: Automation and Us. (The Verge)

You can support Abnormal Returns by visiting Amazon or follow us on StockTwits, Yahoo Finance and Twitter.