Quote of the day

Matt Levine, “The point of a bond ETF is, in large part, to make the illiquid liquid: to make it easy for small investors to buy and sell diversified bond portfolios in small sizes.” (Bloomberg View)

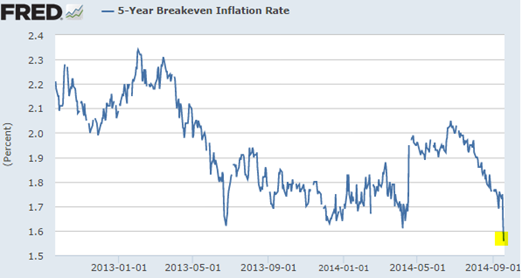

Chart of the day

Inflation expectations have suddenly turned down. (Sober Look)

Investing

Americans need investing advice. The financial media can’t seem to provide it. (The Reformed Broker)

The case for (low cost) active management. (Vanguard Blog)

Strategy

It takes some time to turn over a shareholder base: the case of Yahoo ($YHOO). (Microfundy, Business Insider)

Why averaging down doesn’t make sense. (A Wealth of Common Sense)

Why you shouldn’t fear leverage in risk parity strategies. (AQR)

Finance

Tax inversion deals are filling event-driven traders with angst. (WSJ)

Junk bond investors are getting nervous. (WSJ)

The issue with bond matrix pricing is pervasive. (ETF, FT)

Nobody knows nothing: the venture capital edition. (Fortune)

Where are we in the Bitcoin hype cycle? (A VC also Conversable Economist)

Global

Germany never did gorge on debt. (MoneyBeat)

It will soon be a lot easier to trade Chinese stocks. (Dealbook)

Economy

Weekly initial unemployment claims continue below 300k. (Calculated Risk)

Why haven’t new home sales bounced back more already? (Wonkblog)

How capitalism is saving the environment. (Daniel Gross)

Maybe bond market vigilantes really do exist. (SSRN)

Earlier on Abnormal Returns

What you might have missed in our Wednesday linkfest. (Abnormal Returns)

Mixed media

22 chart-heavy Twitter accounts you need to follow. (Quartz)

Blogger burnout is a real thing. (NYTimes)

One person’s attempt to reduce e-mail overload. (Dan Ariely)

You can support Abnormal Returns by visiting Amazon or follow us on StockTwits, Yahoo Finance and Twitter.