Tuesdays are all about academic (and practitioner) literature at Abnormal Returns. You can check out last week’s links including a look at how to read the academic finance literature.

Quote of the Day

"Overall, our evidence supports the notion that firms can meaningfully increase their market value by increasing the readability of their annual reports. "

(Byoung-Hyoun Hwang)

Chart of the Day

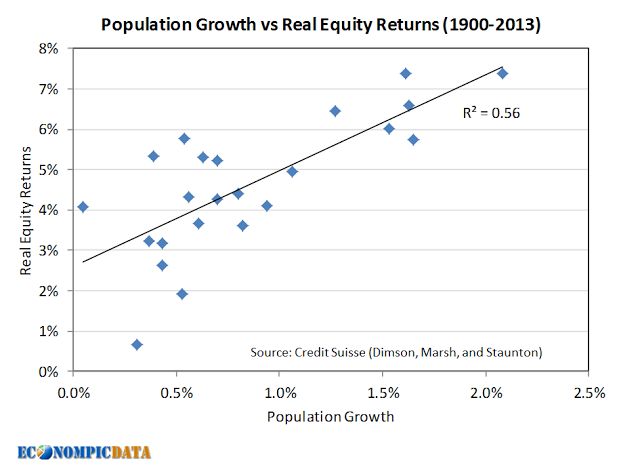

Population growth, not per-capital GDP growth affects stock market returns.

Factors

- Can social media sentiment ever be a robust factor? (blog.alphaarchitect.com)

- The value premium is BOTH a compensation for risk and behavioral mispricing. (blog.alphaarchitect.com)

- Investors don't get compensated for size risk. (factorresearch.com)

Abnormal Returns 2017 Campaign

Research

- David Siegel, "Ultimately, the greatest beneficiaries of a more scientific approach to investing are asset owners, be they individual retirees or large institutions." (wsj.com)

- Is there manipulation around $VIX futures expirations? (papers.ssrn.com)

- What motivates buy-side analysts to put their recommendations online? (pubsonline.informs.org)

- A big part of differential country returns is due to industry composition. (fortunefinancialadvisors.com)

- Desperate fund managers use complex instruments. (etf.com)

- VC fund of fees perform better than their private equity cousins. (institutionalinvestor.com)

- The downside of Monte Carlo simulation methods. (medium.com)