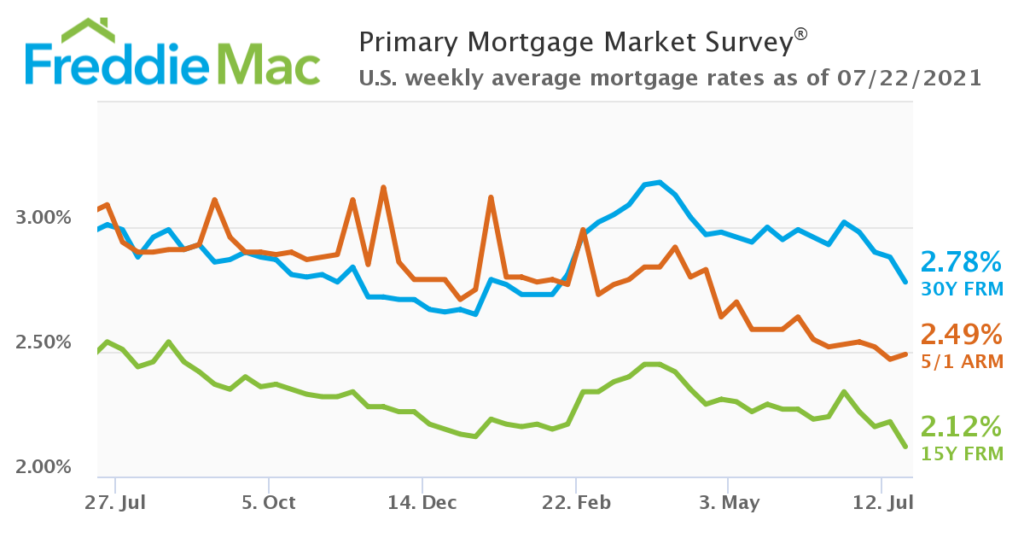

A follow-up to a couple of recent posts. The first involves mortgage refinancing. Since the beginning of the year I have writing about the opportunity homeowners have to reduce their mortgage payments (January, February, April). After a false start this Spring, mortgage rates are once again declining well below the 3.0% level.

Source: Freddie Mac

You can see from the chart above the 15-year mortgage rate is lower than it was back in January. Sam Ro writing at Axios:

The bottom line: “With mortgage rates falling again to near record lows, combined with the removal of the adverse market fee effective August 1st, we will likely see another increase in refinance activity from already elevated levels,” Bill McBride, housing economist at Calculated Risk, tells Axios.

Last week I wrote about the demographic cliff the world is approaching in the next few decades. Some might think that the U.S. is immune to this issue. That would be a mistake. Janet Adamy and Anthony DeBarros writing at the WSJ show how existing demographic trends are being exacerbated by the pandemic. The U.S. is nearing situation where births barely exeed deaths.

Source: WSJ

Adamy and DeBarros go one to show how this is playing out in rural areas where the trends are even worse. They show that in nearly half the states in 2020 there were more deaths than births. They write:

Before the pandemic, in 2019, only a handful of states ended the year with a deaths surplus: West Virginia, Maine, New Hampshire, Rhode Island and Vermont. Now the states where deaths exceed births are all over the U.S., from Wisconsin and Michigan to South Carolina and Florida to Montana and Oregon, according to provisional data from the National Center for Health Statistics at the Centers for Disease Control and Prevention.

There are no easy solutions for this problem. Demographic trends are not easily bent by outside forces. Just something else to keep an eye on as we come out on the other side of the pandemic.