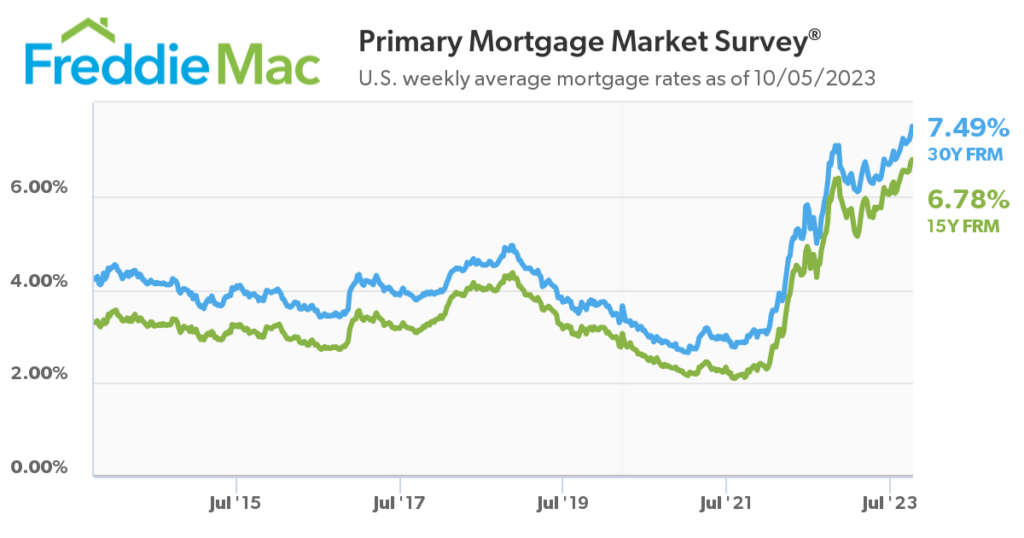

30-year mortgage rates are headed for 8%. Rising interest rates have obviously had an effect, but there are some other technical reasons why mortgage rates are as high as they are.

Source: Freddie Mac

As you can see there was a period of more than a year when you could have refinanced your existing mortgage at a rate less than 3%. Even longer if you make the cut-off 4%.

Unlike in the financial markets, refinancing a mortgage comes with more certain outcomes. When you refinance you mortgage there are some costs, but there isn’t a lot of potential downside. If rates continue to fall you could always refinance again, but the lower mortgage payments stick around.

As early as March 2020, we noted how spending time on your mortgage was a better use of your time than wallowing in pandemic-related fear. We wrote:

In the very short run you can’t change where you live, without moving, but you can change how much you pay on a mortgage. So if you haven’t checked out what is going on with mortgage rates, why not? Refinancing a mortgage is a paperwork hassle, no doubt. However, unlike trying to time and zigs and zags in stock market there is a guaranteed payoff.

We doubled down on the idea of refinancing your mortgage in January 2021 amid the meme stock madness. We wrote.

There are plenty of things you can do in the new year to improve your finances. If nothing else, put refinancing your mortgage on your radar screen for 2021. Unlike trading Tesla or Bitcoin, the mortgage application process takes a lot longer than a few seconds. Rates could continue going lower – weird stuff happens all the time. But you don’t want to regret locking in a historically low mortgage rate amidst everything else going on in this crazy world.

We again mentioned the idea three months later. We don’t always get second chances in life, but this was one of them.

Millions of home borrowers have another opportunity. It’s not news that the housing market is all manner of weird right now. But if you are planning to stay in your place for awhile you are getting a rare second chance at a lower mortgage rate.

Not only did they lock in lower rates, but most are benefiting from higher home prices as well. One of the reasons why the American economy is hanging in there in the face of higher rates is that many homeowners did take advantage of historically low mortgage rates. I hope you were among them.